The AI-Native TMS Procurement Framework: How European Buyers Can Evaluate Next-Generation Transport Software While Managing Regulatory and Hidden Costs

European procurement teams face a critical decision point in 2025. The TMS as we knew it is dead, according to Rose Rocket CEO Justin Sky, whose company recently launched TMS.ai at the Manifest 2025 conference. Yet this technological disruption coincides with mounting regulatory pressure as Member States may start developing the IT systems necessary to allow authorities to check eFTI compliant transport information starting January 2025, with full eFTI Regulation implementation required by July 9, 2027.

Most procurement frameworks built for traditional TMS evaluation miss these converging forces. You need an approach that weighs AI-native capabilities against regulatory compliance costs while preventing vendor lock-in through smart contract structures. Here's how to build that framework.

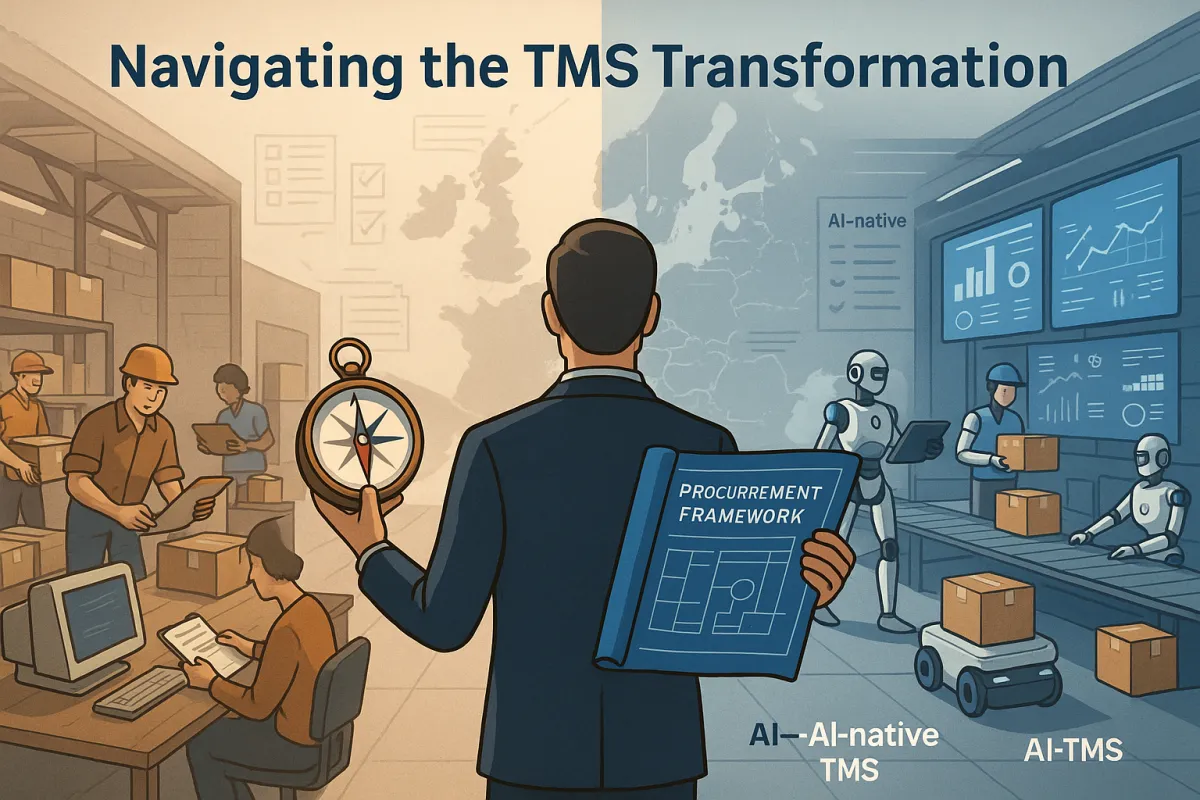

The Shifting TMS Landscape: Why Traditional Evaluation Models Fall Short in 2025

The transportation management system market is experiencing what some call a fourth-generation shift. TMS.ai represents a monumental shift in transportation management systems, embedding artificial intelligence (AI) at the core of a business's system-of-record. This shift allows AI to have the complete context of a business, solving AI's biggest weakness while delivering unparalleled value to every operations team.

This isn't just about adding chatbots to existing platforms. TMS.ai learns and understands organizational context, capturing real information to combat AI's biggest technological weakness—hallucinations, where AI generates incorrect or misleading outputs due to a lack of context or incomplete data. By grounding its intelligence in accurate, actionable information, TMS.ai ensures reliable decision-making.

The performance benchmarks are substantial. DataBot reduces input time on average by 75%, while Rosie cuts load-matching time by 90% and AI-powered invoice matching eliminates 80% of manual inputs and audits. These aren't theoretical improvements—they represent measurable efficiency gains that affect your total cost of ownership calculations.

Meanwhile, the Transportation Management System market is expected to reach USD 2.27 billion in 2025 and grow at a CAGR of 8.92% to USD 3.47 billion by 2030, with SAP SE, Oracle Corporation, Blue Yonder, Descartes Systems Group and Manhattan Associates as the key companies. However, competitive pressure is intensifying as new entrants like Cargoson offer AI-enabled capabilities alongside established players like MercuryGate and Blue Yonder.

European Regulatory Pressures Creating New Evaluation Criteria

The eFTI timeline creates unavoidable procurement deadlines. As of January 2025: Based on the implementation specifications provided in these first eFTI implementing and delegated acts, Member States may start developing the IT systems necessary to allow authorities to check eFTI compliant transport information. By September 2025: The Commission plans to adopt the remaining eFTI implementing specifications. These will provide detailed functional and technical requirements for the IT systems and services to be used by businesses (eFTI platforms and eFTI service providers) and the rules for their certification.

The business impact extends beyond compliance. The introduction of Electronic Freight Transport Information could save the EU transport and logistics sector up to €1 billion per year. By creating common standards and making systems work together, eFTI paves the way for fully paperless transport in the EU.

CSRD requirements add another layer of evaluation complexity. While scope changes have narrowed some requirements, extended deadlines affect reporting obligations that your TMS must support. This creates a dual challenge: selecting AI-native capabilities while ensuring regulatory readiness from vendors ranging from established providers like Descartes and Oracle to newer solutions like Cargoson.

The Five-Pillar AI-Native TMS Evaluation Framework

Traditional TMS procurement focuses on functional requirements and pricing. AI-native evaluation requires a fundamentally different approach across five distinct pillars.

Pillar 1: AI Integration Architecture

The critical distinction lies between AI-native and bolt-on approaches. Unlike other solutions that add AI as an afterthought onto existing systems, TMS.ai is built AI-native. This means that from day one, TMS.ai learns and understands organizational context. Ask vendors to demonstrate how their AI accesses your transportation data in real-time, not through batch processing or separate interfaces.

Key evaluation questions include: Does the AI operate within the core TMS database? Can it access historical shipment patterns, carrier performance data, and rate information simultaneously? How does the system prevent hallucinations when making carrier recommendations or route optimizations?

Pillar 2: Regulatory Readiness

eFTI compatibility requires specific technical capabilities. As of January 2026: eFTI platforms and service providers can start preparing for operations. Member States authorities may start accepting data stored on certified eFTI platforms for inspection. Your TMS must demonstrate clear roadmaps for eFTI platform integration and certification support.

CSRD Scope 3 emissions tracking becomes mandatory for many organizations. Evaluate whether vendors can collect, standardize, and report transportation emissions data that will satisfy auditors. Solutions like Cargoson, Oracle TM, and Descartes are developing these capabilities, but implementation timelines vary significantly.

Pillar 3: Total Cost Transparency

AI-native TMS pricing models differ substantially from traditional approaches. Cloud TMS Price: Based on number of monthly shipment transactions the cost is $1.00 to $4.00 per freight load booked in the system. Licensed TMS Price: TMS buyers can expect to pay anywhere between $10,000 to $250,000 for the license, plus an annual maintenance fee.

However, hidden fees and unforeseen costs include unanticipated expenses such as third-party integration charges, additional feature licensing, scaling costs, and penalties for contract breaches. These can add 25-30% more than initially estimated. Demand detailed cost breakdowns that include AI processing fees, data storage costs, and integration charges for regulatory reporting.

Pillar 4: Vendor Independence

AI-native systems create new forms of vendor dependency through data training and model optimization. Negotiate clear data portability terms that include your historical transportation data and AI training datasets. Establish performance guarantees tied to specific AI metrics—load matching accuracy, route optimization improvements, and invoice processing accuracy.

Pillar 5: SME Scalability

European SMEs represent the fastest-growing TMS segment, with cloud democratizing enterprise-grade optimization. Your framework must assess how solutions accommodate growth without penalty costs. The transaction-based model offers scalability, as the cost is directly tied to the usage and workload of the shipper. It allows companies to pay for the TMS based on their actual transportation volumes, but typically with some minimum shipment volume that is inversely correlated with the size of the transaction fee.

Cost Structure Analysis: Beyond Per-Shipment Pricing

Traditional TMS cost models break down when evaluating AI-native platforms. Cloud-based TMS Software will run you $2-$5 per load you book or a 5 figure annual subscription cost. Licensed TMS software will run you $50,000-$400,000+ and will often come with annual/monthly maintenance and support fees.

AI processing introduces additional cost variables. Some vendors charge percentage-based fees on freight under management, while others use hybrid models combining base subscriptions with AI processing charges. Unlike some SaaS models, cloud-based TMS does not charge per user or transaction. Instead, it charges as a percentage of Freight Under Management (FUM), allowing customers to fully use the TMS without artificial restraints.

Compare these models carefully. Enterprise solutions from Oracle TM and SAP TM can reach $250,000-$1,000,000+ annually, with implementation costs often exceeding $1,000,000. Meanwhile, solutions like Cargoson offer more transparent pricing structures that may better suit mid-market requirements.

AI Capability Assessment: Separating Marketing from Reality

Every TMS vendor now claims AI capabilities. Your evaluation must distinguish between genuine AI-native functionality and marketing positioning.

Use Rose Rocket's benchmarks as evaluation standards. DataBot reduces input time on average by 75%, Rosie cuts load-matching time by 90%, and AI-powered invoice matching eliminates 80% of manual inputs and audits. Request similar performance metrics from all vendors, with specific measurement methodologies.

Create RFP questions that reveal AI maturity levels:

- How does your AI system handle incomplete or conflicting shipment data?

- What training data sources inform your route optimization algorithms?

- How do you measure and prevent AI hallucinations in carrier recommendations?

- Can your AI learn from our specific transportation patterns and constraints?

Evaluate vendor responses against the competitive landscape. Established players like Transporeon, nShift, Blue Yonder, and MercuryGate offer different AI maturity levels, while newer entrants like Cargoson may provide more agile AI development approaches.

Regulatory Compliance Scoring Matrix

Develop quantitative scoring for eFTI readiness and CSRD capabilities. As of 9 July 2027: The eFTI Regulation will apply in full. Member State authorities must accept information shared electronically by operators via certified eFTI platforms.

Score vendors on:

- eFTI platform integration timeline (0-25 points)

- Certified service provider partnerships (0-25 points)

- CSRD Scope 3 emissions data collection (0-25 points)

- Data residency and GDPR compliance (0-25 points)

Vendors scoring below 70 points carry significant regulatory implementation risk. Solutions like Descartes and Oracle typically score higher on compliance readiness, while Cargoson and other emerging platforms may offer more flexibility in regulatory feature development.

Contract Negotiation Tactics for AI-Native TMS Deals

AI-native TMS contracts require specific clauses that don't exist in traditional software agreements.

Transparent Cost Structure Clauses

Negotiate caps on AI processing fees and data storage costs. Include clauses that prevent surprise charges as your shipment volumes grow or AI capabilities expand. Define exactly what constitutes a "transaction" for pricing purposes, especially when AI systems automatically optimize multi-leg shipments or consolidate orders.

Data Ownership and Portability

Establish clear ownership of AI training data derived from your transportation patterns. Include provisions for exporting not just raw shipment data, but also AI insights and optimization parameters that the system has learned about your operations. This prevents vendor lock-in through proprietary AI models trained on your data.

Performance Guarantees

Link contract terms to specific AI performance metrics. Include service level agreements for load matching accuracy (targeting 90%+ based on Rose Rocket benchmarks), data processing time reductions (75% improvement targets), and invoice processing automation rates (80%+ automation).

Include penalty clauses for underperformance and bonus structures for exceeding AI performance targets. This aligns vendor incentives with your operational improvements.

Regulatory Compliance Guarantees

Include specific clauses addressing eFTI compliance by the July 2027 deadline. Vendors should guarantee platform certification and integration support without additional fees. Include termination rights if vendors fail to achieve regulatory compliance within specified timeframes.

Implementation Roadmap: 90-Day AI-Native TMS Selection Process

Phase 1: Market Scan Using Five-Pillar Framework (30 Days)

Days 1-10: Conduct initial market research using the five-pillar evaluation framework. Create vendor shortlists based on AI architecture, regulatory readiness, and cost transparency. Include established players like Blue Yonder, Descartes, and Oracle alongside emerging solutions like Cargoson.

Days 11-20: Develop detailed RFI templates focusing on AI capabilities and regulatory compliance. Request specific performance benchmarks, implementation timelines, and cost breakdowns including hidden fees.

Days 21-30: Score vendor responses using the regulatory compliance matrix and AI capability assessment criteria. Eliminate vendors scoring below 70 points on regulatory readiness.

Phase 2: Vendor Evaluation and RFP Process (45 Days)

Days 31-45: Conduct AI capability demonstrations with shortlisted vendors. Request live demos showing how AI handles your specific transportation data and scenarios.

Days 46-60: Perform detailed cost analysis using total cost of ownership models that account for AI processing fees, regulatory compliance costs, and scaling charges.

Days 61-75: Execute proof-of-concept implementations with top two vendors, focusing on AI performance against Rose Rocket benchmarks and regulatory data collection capabilities.

Phase 3: Final Selection and Contract Negotiation (15 Days)

Days 76-85: Complete vendor scoring across all five pillars and conduct final stakeholder reviews. Present business cases that quantify AI-driven efficiency gains and regulatory compliance benefits.

Days 86-90: Negotiate final contract terms using AI-native negotiation tactics, including performance guarantees, data portability clauses, and regulatory compliance guarantees.

The convergence of AI capabilities and regulatory requirements creates both opportunity and risk in TMS procurement. Organizations that implement comprehensive evaluation frameworks now—assessing AI architecture, regulatory readiness, cost transparency, vendor independence, and scalability—will secure competitive advantages while avoiding compliance penalties.

The July 2027 eFTI deadline approaches quickly. Your TMS selection in 2025 must balance AI-native capabilities with regulatory compliance costs while preventing vendor lock-in through smart contract structures. Use this framework to evaluate solutions ranging from established enterprise platforms to emerging alternatives like Cargoson, ensuring your choice delivers both operational excellence and regulatory readiness.