TMS API Integration RFP Template: The European Procurement Checklist That Prevents €500K+ Custom Development Disasters While Ensuring Regulatory Compliance

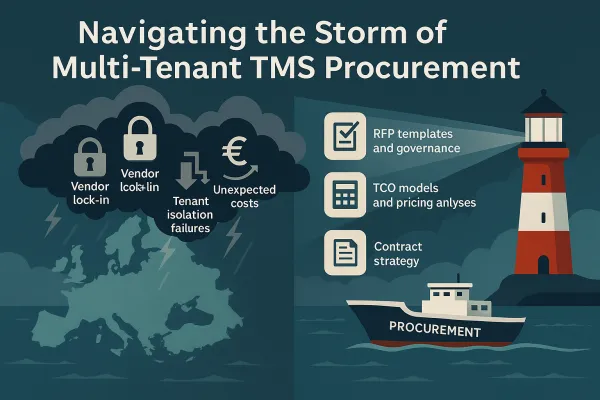

A German automotive parts manufacturer discovered their €800,000 TMS implementation mistake the hard way. Six months into deployment, they found their European carriers couldn't integrate without costly custom development work - turning their "smart procurement decision" into a complete platform re-implementation. Sound familiar?

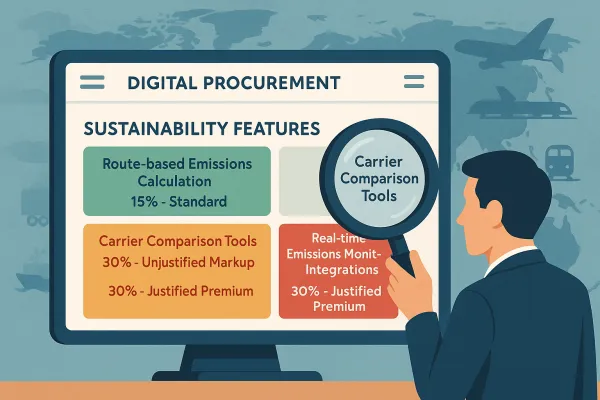

The hidden costs in TMS procurement consistently add 25-30% more than initial estimates, but integration failures represent the highest-impact risk European shippers face when selecting transport management software. A basic domestic shipper needs 10-15 integrations minimum, totaling 1,000-1,500 hours of labor, while most shippers today require an average of 40 integrations.

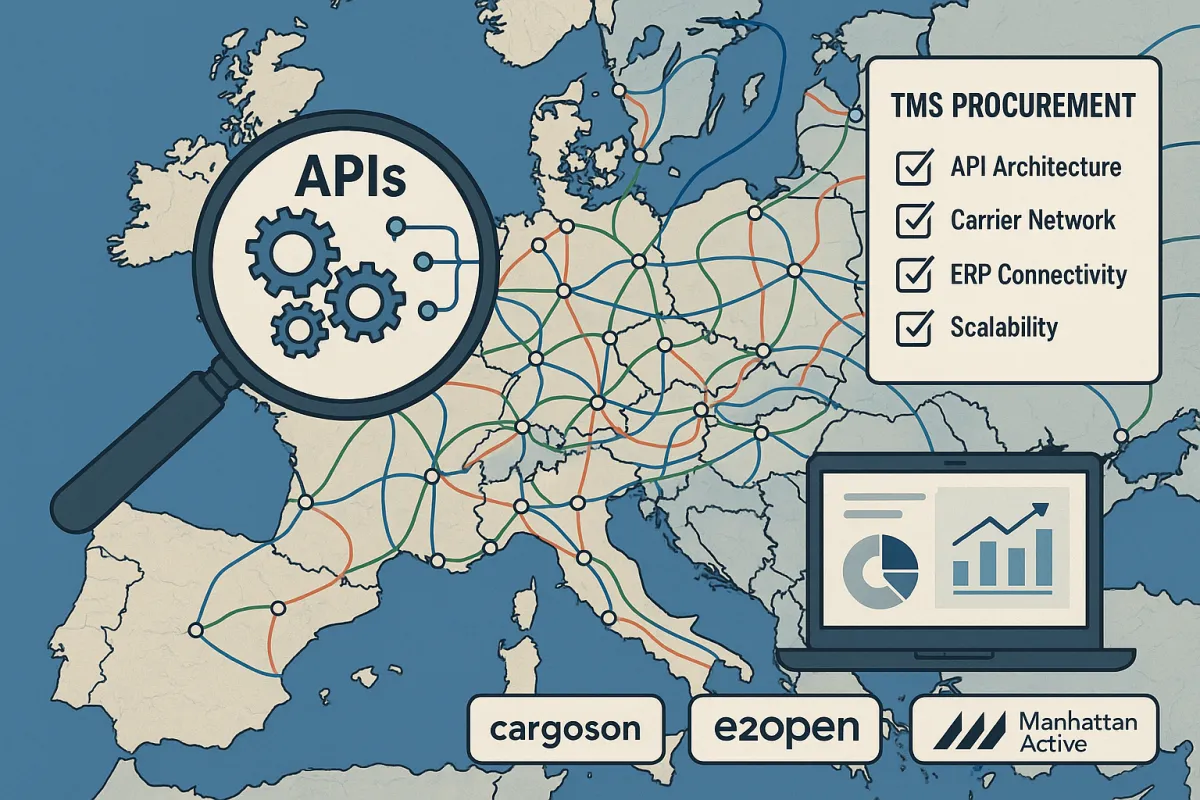

With the eFTI Regulation applying in full by 9 July 2027 and starting 19 August 2025, all heavy-duty vehicles registered in the EU and operating in Member States other than their Member State of registration must be fitted with G2V2 devices, API-first TMS integration capabilities have moved from nice-to-have to mandatory requirement.

The True Cost of API Integration Failures in European TMS Procurement

Basic API integrations cost €5,000-€15,000, while complex ERP connections exceed €50,000. Now multiply that across your carrier network. Many carriers aren't willing or able to create API connections, and even when they are, they'll charge integration costs to you. European shippers working with 20-30 regular carriers face substantial connectivity expenses that vendors rarely discuss during initial demos.

The math becomes harsh when you factor in regulatory requirements. For shippers with annual freight under management exceeding €250M, implementation costs often run 2-3x the subscription fees. Yet procurement teams spend roughly 240 hours on tender events without proper TCO modeling that accounts for integration complexity.

Here's what separates successful European implementations from disasters: vendors approach carrier connectivity differently. While many TMS solutions offer published APIs, carriers are often unwilling or unable to create connections themselves, and even when they can, they typically charge integration costs back to the shipper. Modern European providers like Cargoson build true API/EDI connections versus basic account setup, while platforms like Transporeon require carriers to implement standard EDI.

Your RFP template needs to surface these differences upfront, not six months into deployment.

RFP Section 1: API Architecture and Standards Assessment

Start your technical evaluation with architecture fundamentals that prevent expensive surprises later:

- API Standards Compliance: "Describe your REST API architecture, JSON support, and authentication methods. Provide OpenAPI specification documentation for review."

- Real-Time Capabilities: "What is your guaranteed response time for shipment tracking queries? How do you handle high-volume API requests during peak periods?"

- Integration Flexibility: "Demonstrate how your APIs handle custom data fields required by our specific workflow without custom development work."

- Data Migration Approach: "Outline your process for migrating existing shipment data, carrier contracts, and routing rules via API connections."

- Security Certifications: "Provide current ISO 27001, SOC 2, and GDPR compliance documentation. How do you handle data residency requirements for EU operations?"

The scoring criteria should weight technical architecture heavily - most TMS vendor scoring frameworks were built for a different market. Allocate 25-35% of your total score to API integration capabilities, not just feature checklists.

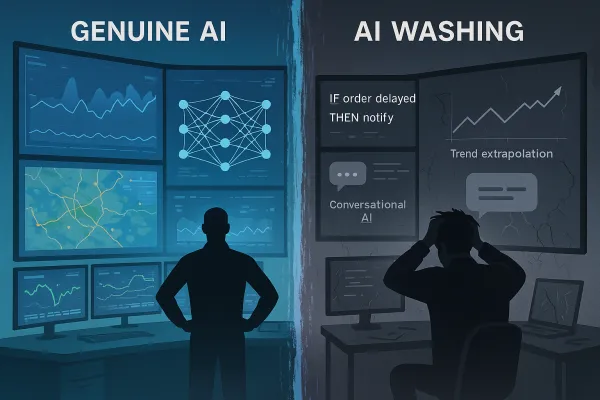

When evaluating responses, create a vendor comparison matrix including established players like Alpega, E2open, and Manhattan Active alongside emerging solutions like Cargoson. Position API maturity as equally important as carrier network size - it doesn't matter how many carriers they claim to support if integration takes months and costs thousands per connection.

RFP Section 2: Carrier Connectivity and Third-Party Integration

This section reveals whether vendors truly support European operations or just claim to:

- Carrier Network Reality Check: "List your top 20 European carriers by shipment volume, including integration method (API, EDI, or manual) and average connection timeline."

- Integration Cost Transparency: "Who pays integration costs? How long do new carrier connections take? What happens when carriers change their API requirements?"

- Digital Broker Support: "Demonstrate real-time freight procurement capabilities through your API connections to spot markets, freight exchanges, and digital brokers."

- Multi-Modal Capabilities: "Show API integration examples for parcel, LTL, FTL, rail, and ocean freight modes with actual European carriers."

- ERP/WMS Connectivity: "Provide technical documentation for SAP, Oracle, Microsoft Dynamics integrations, including pre-built connectors versus custom development requirements."

Watch for red flags in vendor responses. While carriers can easily join platforms through their portal, requesting completely new carrier API/EDI integrations is more complex and costly. Vendors confident in their integration capabilities will provide detailed technical documentation and reference customers using similar configurations.

Platforms like Cargoson, alongside Transporeon and nShift, offer different approaches to carrier connectivity. Platforms like Cargoson, alongside solutions from Transporeon, nShift, and others, have responded by offering dual-mode capabilities. This approach acknowledges that European shippers don't have the luxury of choosing just one integration standard.

RFP Section 3: Regulatory Compliance and Future-Proofing

Regulatory compliance represents your strongest negotiation leverage - use it:

- eFTI Readiness Timeline: "eFTI platforms and service providers can start preparing for operations as of January 2026". Require detailed roadmaps for platform certification and authority integration testing.

- Electronic Documentation Standards: "Data will only be shared with authorities upon explicit inspection request, using unique access links in machine-readable formats such as QR codes". Your TMS must generate these automatically.

- Cross-Border Data Handling: "Business data will be housed on secure, certified IT platforms that can be easily integrated with companies' existing data management systems". Specify EU data residency requirements and integration standards.

- Regulatory Update Process: "How do you handle regulatory changes? What's included in base pricing versus additional development costs for compliance features?"

Structure regulatory compliance as vendor obligation, not buyer option. A Netherlands-based logistics provider avoided a €400,000 annual cost increase by negotiating compliance feature inclusion in their 2024 renewal. Their contract specified that all EU regulatory requirements through 2028 were included in base pricing, with vendor penalties for non-delivery. When eFTI compliance became available in Q3 2026, they activated it without additional fees while competitors paid premium pricing.

Leading TMS providers like MercuryGate, Descartes, and Cargoson are already preparing eFTI-compatible solutions. Include all major players in your evaluation but weight regulatory readiness heavily - it's not enough to promise future compliance.

RFP Section 4: Implementation Timeline and Cost Controls

Control implementation variables before they control your budget:

- Phased Deployment Approach: "Q2-Q3 2025: Implementation and Testing - Deploy core TMS functionality with limited AI features enabled", followed by "Q4 2025: AI Feature Activation and Optimization - Enable advanced AI capabilities after core system stability".

- Integration Service Limits: "Provide fixed-price quotes for your first 15 carrier integrations, with transparent hourly rates for additional connections."

- Change Request Process: "Define your change request approval process, cost estimation methodology, and maximum timeline for scope modifications."

- Performance Guarantees: "Specify uptime SLAs, API response time guarantees, and financial penalties for non-performance."

The implementation timeline should account for regulatory preparation. "Q1 2026: eFTI Compliance Preparation - eFTI platforms and service providers can start preparing for operations beginning January 2026, with authorities starting to accept data stored on certified platforms".

Build cost protection into your contract terms: caps on annual maintenance increases, penalties for delivery delays, and data portability guarantees. Licensed TMS models include annual maintenance charges ranging from 15-20% of license costs, while traditional software maintenance fees often run around 20% of the license fee annually for support and minor upgrades.

RFP Section 5: Vendor Scoring Matrix for API Integration

Weight your evaluation criteria to surface integration risks early:

- Technical Architecture (35%): API standards, integration capabilities, security certifications

- Implementation Complexity (25%): Timeline predictability, resource requirements, change management

- Total Cost of Ownership (25%): Integration costs, maintenance fees, regulatory compliance expenses

- Vendor Stability (15%): Financial strength, customer references, regulatory readiness

Compare vendors across implementation complexity, not just feature coverage. Vendors like MercuryGate, Descartes, and Cargoson offer different approaches to implementation complexity. Manhattan's total cost of ownership ranks as relatively high, while cloud-native solutions like Cargoson focus on reducing implementation complexity through pre-built integrations and European carrier connectivity.

The most telling question: "What would our actual monthly invoice look like in month 6, 12, and 24 based on our volume projections?" Vendors confident in their pricing transparency will provide detailed breakdowns. Others will deflect or provide vague estimates.

Downloadable Template and Next Steps

Your TMS API integration RFP should include all sections above, formatted as a comprehensive template with scoring matrices, technical requirements, and contract term recommendations. The key success factor? Start now.

Build that TCO model now, before the eFTI deadline creates time pressure that compromises your negotiating position. The regulatory timeline creates procurement urgency but also negotiation leverage.

Follow this implementation approach: Q2-Q3 2025 for core deployment, Q4 2025 for advanced features, and Q1 2026 for eFTI preparation. The convergence of AI maturity, regulatory requirements, and proven ROI has created a procurement window where the risk of inaction may exceed the cost of implementation.

Include contract negotiation tactics that protect against post-selection pricing changes: data portability guarantees, regulatory compliance inclusion, and performance-based pricing structures. Your leverage is strongest when vendors need your commitment to justify their development investments. Use this timing to secure better terms, stronger protections, and predictable costs through the compliance transition period.

The vendors with genuinely transparent integration approaches will welcome detailed technical evaluation. The others will reveal themselves through deflection, vague timelines, and reluctance to provide references. Choose accordingly - your regulatory compliance and competitive advantage depend on it.