TMS Sustainability Markup Alert: The Procurement Framework That Stops Vendors Charging 30% Premiums for Standard Carbon Reporting Features

European procurement teams are discovering that TMS sustainability features can inflate budgets by 25-30% beyond initial estimates while navigating mandatory CSRD requirements. Basic carbon tracking add-ons typically increase total system costs by 15-30%, even when the underlying calculation engines rely on standard emission factors from frameworks like GLEC. This procurement framework exposes vendor markup tactics and ensures CSRD compliance without bleeding budget.

The 30% Sustainability Markup Reality

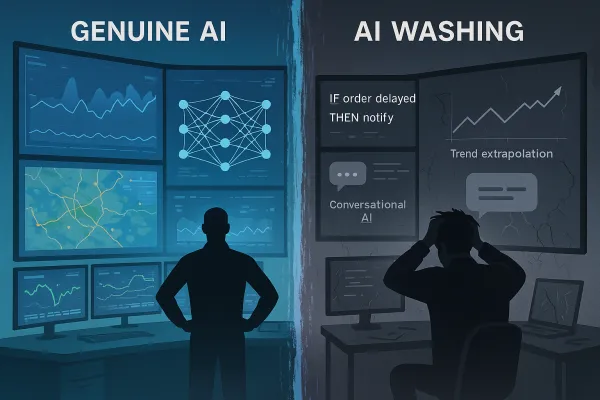

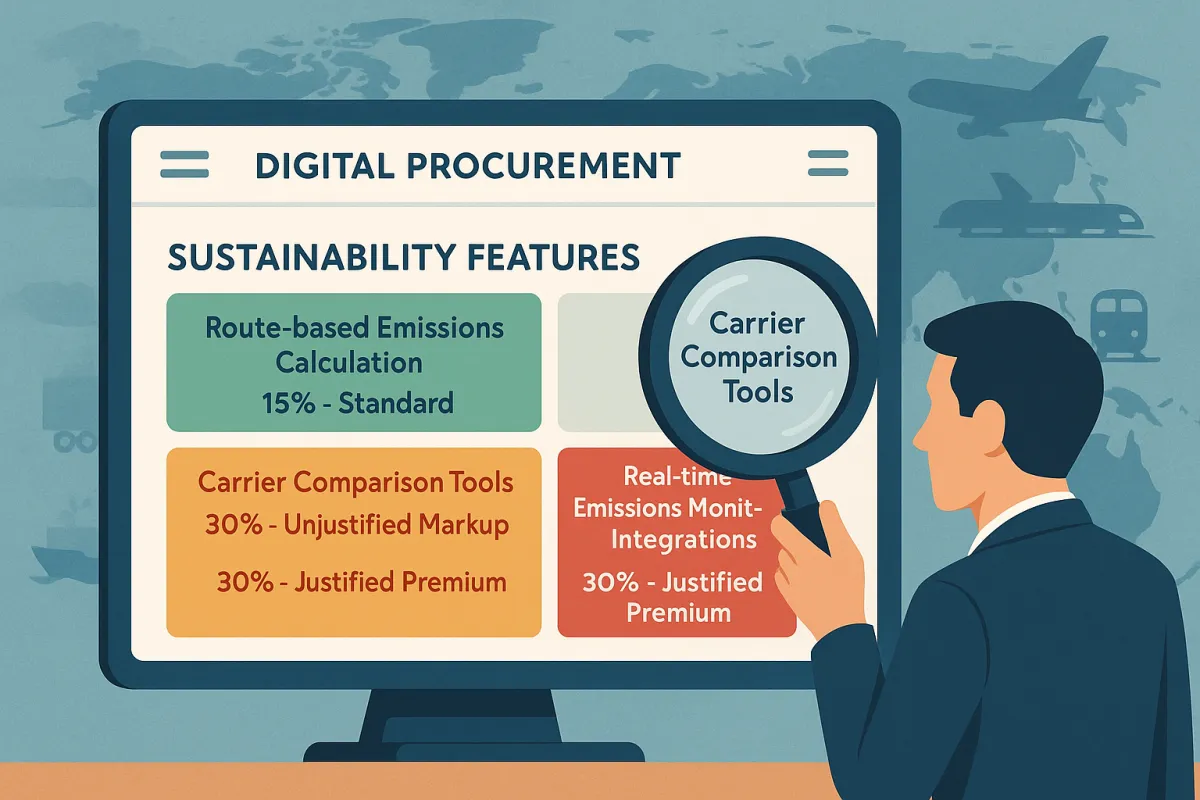

Vendors systematically charge premiums for carbon tracking that should cost far less. Basic carbon tracking add-ons typically increase total system costs by 15-30%, even though most rely on publicly available emission factors from GLEC or similar frameworks. The calculation engine underneath these "premium" features often performs standard multiplications using distance, weight, and mode-specific coefficients.

Europe leads in sustainability-driven TMS adoption due to strict emissions regulations, carbon reporting mandates, and low-emission zone compliance. This regulatory pressure creates artificial scarcity, with vendors positioning basic emissions reporting as advanced functionality. You're paying premium prices for what amounts to spreadsheet calculations packaged in dashboard form.

Supply chain sustainability looks different across industries, but interest tends to be higher in Europe, with global companies also trying to capture emissions data and prepare for future reporting needs. The pressure to get compliant quickly plays into vendor hands, driving procurement teams toward expensive solutions without proper cost analysis.

CSRD Compliance vs. Vendor Opportunism

Under the CSRD, Scope 3 reporting is required. Organisations must provide comprehensive information on their indirect emissions throughout the value chain. For transport, this means emissions from transport must be accurately calculated and audited.

In the EU, large, listed companies need to begin reporting in 2025 under CSRD, while large companies meeting at least two of three criteria must publish their first sustainability report in 2026, covering the year 2025. The tight timeline creates decision pressure that vendors exploit through premium pricing for "CSRD-ready" modules.

Legitimate CSRD requirements include calculation methodologies that follow GHG Protocol standards, audit trails for emissions data, and integration with existing financial reporting systems. What shouldn't cost extra: basic route-based emissions calculations, carrier comparison tools, or standard modal optimization that any competent TMS should provide.

What Should Actually Be Standard in 2026

A Shipper TMS is the ideal place to determine the carbon emissions by collecting and analyzing data of all the transportation activities of an organization. Standard functionality should include route distance calculations, weight-based emissions factors, and mode-specific coefficients. A TMS can optimize the different modes of transportation (truck, train, ocean, plane) used by an organization. These different modes have, of course, different carbon footprints.

Vendors often charge extra for features like sustainable carrier scorecards, alternative mode recommendations, or consolidated shipment carbon tracking. These represent basic optimization algorithms that modern TMS platforms should include. TMS platforms now have the capability to monitor and report on the carbon emissions produced by each shipment across all modes of transportation.

Premium pricing becomes justified for real-time emissions monitoring integrations, advanced predictive analytics for route carbon optimization, or custom regulatory reporting templates for specific jurisdictions. The line between standard and premium blurs when vendors bundle basic calculations with genuinely advanced features.

The Procurement Evaluation Framework

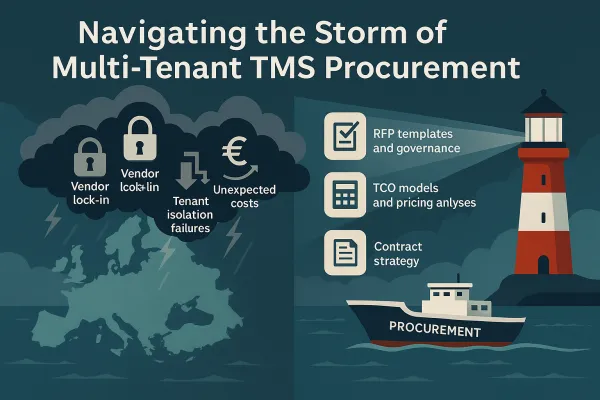

Start with functional requirements that separate regulatory compliance from vendor markup. Request detailed cost breakdowns that itemize emissions calculation licensing, implementation services, ongoing support, and integration expenses. European procurement teams are discovering their TMS budget calculations miss over half the true costs.

Step 1: Baseline Carbon Calculation Requirements

Specify that route-based emissions calculation using standard GLEC factors should be included in base licensing. Any vendor charging separately for basic CO2 calculations reveals markup strategy immediately.

Step 2: Implementation Cost Modeling

Break down total cost of ownership across licensing (typically 20-30%), implementation services (25-40%), training (5-10%), and ongoing support (15-25%). Sustainability features shouldn't dramatically shift these percentages unless genuinely complex integrations are required.

Step 3: Performance Guarantee Requirements

Demand accuracy thresholds for carbon data calculations and remediation procedures when emissions reporting fails audit requirements. Vendors confident in their emissions methodology accept performance guarantees; those charging premiums for basic calculations resist accountability.

Step 4: Future-Proofing Contract Language

Include clauses preventing automatic fee increases for regulatory updates to CSRD or other emissions reporting standards. Under the CSRD, Scope 3 reporting shifts from voluntary best practice to binding requirement. Vendors shouldn't profit from evolving compliance standards.

Negotiation Tactics That Work

Position sustainability features as table stakes for modern TMS, not premium add-ons. Reference competitive alternatives that include emissions tracking in standard packages. Vendors like Cargoson, Alpega, nShift, and Descartes increasingly bundle carbon tracking as core functionality, creating pricing pressure on legacy providers.

Structure contracts with scalability provisions that prevent vendor-controlled upgrade pricing when emissions reporting requirements expand. Specify accuracy thresholds (typically within 10% of actual fuel consumption data) and remediation procedures for calculation errors.

Leverage implementation speed against premium pricing. Cloud-based TMS implementation typically takes 1-4 weeks compared to 6-18 months for traditional on-premise systems. Consider implementation speed as a risk mitigation factor rather than accepting sustainability feature markups from slower-deploying platforms.

TCO Reality Check: Beyond the Sales Pitch

TCO modeling for sustainability-enabled TMS requires balancing compliance investment against penalty avoidance. CSRD non-compliance carries regulatory risk, but sustainability feature markup represents certain cost inflation.

True cost modeling includes integration expenses ranging from £5,000 for simple API connections to £50,000 for complex ERP integrations involving custom emissions calculations. Hidden ongoing costs emerge from emissions data management, audit preparation, and regulatory reporting updates.

Calculate ROI against regulatory risk rather than soft benefits like brand reputation. CSRD compliance is mandatory; paying 30% premiums for basic calculations isn't. Premium solutions can save 10-15% on total freight costs, which for a large company can represent tens of millions of dollars in savings. Ensure sustainability premiums deliver equivalent value.

Red Flags During Vendor Selection

Vendors reluctant to provide detailed cost breakdowns for emissions features hide markup strategies. Vague implementation timelines often mask complex customization requirements that inflate costs post-contract.

Question any vendor positioning basic carbon calculations as "advanced analytics" or requiring separate licensing. By collecting and analyzing data based on these factors, a TMS can provide an accurate estimate of an organization's carbon emissions from their transportation activities. This isn't advanced functionality in 2026.

Watch for vendors offering "CSRD compliance packages" that bundle standard TMS features with basic emissions reporting at premium prices. Preparation for CSRD-aligned Scope 3 reporting should begin with a structured readiness roadmap. Piecemeal efforts won't scale. True compliance requires systematic approach, not expensive feature bundles.

Evaluate vendor sustainability claims against actual functionality. Providers like MercuryGate, Descartes, Oracle, and emerging solutions like Cargoson offer transparent pricing models that separate genuine innovation from regulatory arbitrage. Compare total cost across multiple vendors to identify markup patterns and negotiate accordingly.