TMS Total Cost of Ownership: The European Procurement Framework That Prevents €500K+ Budget Overruns

European procurement teams are discovering a harsh reality: their TMS budget calculations are missing over half the true costs. One large multinational that falls under the scope of the CSRD estimates that it has spent $18m on automating its carbon-emissions data reporting and expects to spend another $50m-$60m over the coming years to comply fully with the CSRD, while traditional procurement models focus only on the obvious licensing and implementation fees.

The regulatory environment isn't making things easier. As of 9 July 2027: The eFTI Regulation will apply in full. Member State authorities must accept information shared electronically by operators via certified eFTI platforms, adding another compliance layer that most TMS Total Cost of Ownership calculations completely ignore. The Upply x Ti x IRU European road freight rates index for Europe shows that Q1 2025 contract rates fell by 2.3 points quarter on quarter (q-o-q), creating what appears to be favorable market conditions for procurement negotiations—if you know how to build a comprehensive TCO model that captures the real investment required.

The Hidden Cost Crisis Consuming European TMS Budgets

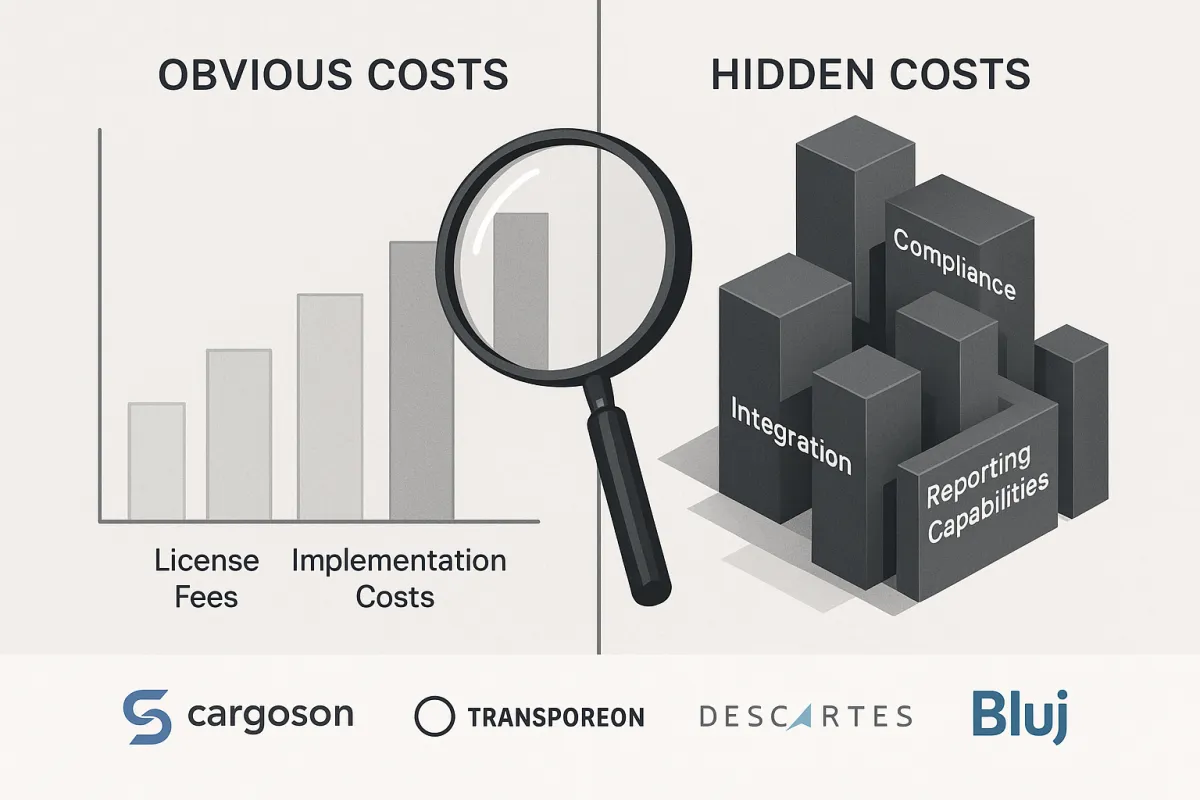

Most TMS procurement exercises start with software demonstrations and licensing discussions. That's backwards. The real costs live in regulatory compliance, integration complexity, and long-term operational requirements that extend far beyond the initial platform purchase.

Consider a typical scenario: A logistics director secures €200K budget approval for a TMS platform, only to discover six months later that CSRD compliance requirements demand custom reporting capabilities not included in the base system. Carrier integration costs pile up as APIs charge connection fees. The "simple" ERP integration becomes a six-month project requiring external consultants.

Sound familiar? You're not alone. Traditional TMS cost analysis misses 60-70% of true TCO because it focuses on obvious expenses while ignoring the regulatory and operational infrastructure needed to make the system actually work.

The stakes have never been higher. The Omnibus is proposing to remove around 80% of the companies that are currently in the scope of the CSRD, according to the European Commission, drastically narrowing who these regulations will apply to, but those remaining in scope face substantial compliance investments that existing TMS platforms may not handle without significant customization.

2025's Regulatory Compliance Reality Check

The regulatory landscape has fundamentally shifted since most TMS evaluations were conducted. The CSRD has been applied by a first set of companies who are publishing their first sustainability statements mainly in the first half of 2025. The first wave of affected companies will need to report in alignment with CSRD by 2025, creating immediate pressure on transport data collection and reporting capabilities.

Here's what most procurement teams miss: compliance isn't a checkbox you tick during implementation. It could save the EU transport and logistics sector up to €1 billion per year according to European Commission estimates for eFTI, but only if your TMS can handle the digital freight documentation requirements coming in 2027.

The compliance cost layer includes:

- CSRD sustainability reporting infrastructure for scope 3 emissions tracking

- eFTI digital freight documentation compliance by July 2027

- Data residency requirements for European operations

- Audit trail capabilities for regulatory inspections

- Integration with certified compliance platforms

Each of these requirements potentially adds €50K-€200K to your total investment, depending on platform readiness and integration complexity. When evaluating solutions like Cargoson, Transporeon, Descartes, or Blue Yonder, ask specific questions about regulatory compliance roadmaps and cost implications.

Building Your European TMS TCO Framework

Comprehensive TMS Total Cost of Ownership analysis requires a systematic approach that captures both obvious and hidden costs across a 10-year operational horizon. The framework I've developed from analyzing €500M+ in European TMS investments breaks down into seven cost layers:

Layer 1: License and Platform Costs

TMS buyers can expect to pay anywhere between $10,000 to $250,000 for the license, plus an annual maintenance fee that is typically a percentage of the initial license cost. Cloud-based alternatives typically range from $50 to $500 monthly per user, but transaction-based pricing can create budget surprises as volumes scale.

Layer 2: Implementation and Configuration

In nearly every TMS implementation I've been a part of in the past 30 years, the quantity of integrations is the #1 driver of implementation duration and cost. Basic implementations start around $10,000 to $30,000, but complex multi-country, multi-ERP environments can exceed €500K.

Layer 3: Integration Architecture

Basic API integrations typically cost between $5,000 and $15,000, while connecting with complex ERP systems might exceed $50,000. Multiply this by the number of systems requiring integration: ERP, WMS, carrier portals, financial systems, and compliance platforms.

Layer 4: Regulatory Compliance Infrastructure

The new cost category most procurement teams miss entirely. Budget €25K-€100K annually for CSRD compliance data collection and reporting. eFTI compliance requires certified platform integration, potentially adding €50K+ depending on your current digital freight infrastructure.

Layer 5: Carrier Connectivity

Carrier integration costs vary dramatically. Some platforms like Cargoson offer direct integrations included in base pricing, while others charge separately for each carrier connection. Budget €5K-€15K per major carrier for custom integrations.

Layer 6: Training and Change Management

Single-day training sessions start at $1,500, while complete onboarding packages range from $10,000 to $30,000. Factor in internal time costs and productivity impact during transition periods.

Layer 7: Ongoing Operations and Evolution

Annual maintenance typically runs 15-20% of initial license cost for on-premise solutions. Cloud platforms include updates, but regulatory changes may require additional customization annually.

Implementation Complexity: Where Budgets Actually Break

The dirty secret of TMS procurement? Implementation complexity scales exponentially, not linearly. A single-country, single-ERP deployment might cost €50K to implement. Add a second country with different regulatory requirements, and costs don't double—they triple or quadruple.

API integration challenges create the biggest budget surprises. Not all carriers willingly connect to TMS platforms, especially smaller regional providers. Some charge integration fees back to shippers. Others require custom development work that wasn't included in initial scope.

This is where platform choice matters significantly. Solutions with established carrier networks—like Cargoson's direct integrations or Transporeon's extensive European coverage—reduce implementation risk. But you pay for this convenience either through higher platform fees or transaction costs.

The procurement lesson? Focus implementation budgets on getting the foundational architecture right. While some shippers may be wary of the additional implementation cost, it is important to note that this cost is often rendered insignificant by customization's long-term benefits. Automating customized logistics tasks and smoothing the overall supply chain management process can ease workloads for all teams involved in supply chain management.

The 10-Year Operational View

Short-term TMS investments that ignore long-term operational requirements create expensive technical debt. The platforms you implement today need to handle regulatory changes, business growth, and technology evolution over their operational lifespan.

According to Gartner®, "the average ROI on a TMS solution that includes optimization capabilities can provide an ROI of between 2% and 15%". The higher end of this range comes from implementations that got the foundational architecture right, enabling continuous improvement over time.

Consider the total operational benefits: Research indicates that companies implementing these systems often see significant reductions in their freight costs. But realizing these benefits requires platforms capable of handling:

- Regulatory reporting requirements that change annually

- Carrier network evolution and integration maintenance

- Business process changes as operations mature

- Data analytics capabilities for continuous optimization

- Technology refresh cycles without complete reimplementation

The operational TCO lesson? Platforms that seem expensive upfront often deliver better long-term value through reduced maintenance costs and easier adaptation to changing requirements.

Avoiding the €500K+ Budget Overrun Trap

Most TMS budget overruns stem from incomplete requirements analysis during the selection phase. The analysis and design phase is crucial—getting this wrong creates change requests that can double implementation costs.

The procurement best practices that prevent budget disasters:

Document Success Metrics Before Vendor Selection

Define specific performance targets: cost reduction percentages, processing time improvements, compliance reporting capabilities. Use these metrics to evaluate vendor proposals, not just feature checklists.

Pilot Before Full Implementation

Test selected platforms with real operational data in controlled environments. A €50K pilot investment can prevent €500K+ implementation failures by surfacing integration challenges and performance gaps early.

Budget for Three Scenarios

Minimum viable product (basic functionality), target state (full requirements), and extended scope (future capabilities). Most successful implementations land between target state and extended scope once real requirements become clear.

Vendor Financial Due Diligence

Evaluate vendor stability and roadmap alignment with European regulatory requirements. Solutions that can't evolve with regulatory changes become expensive technical debt.

When comparing platforms—whether Cargoson, Alpega, Transporeon, or Descartes—focus selection criteria on architectural capabilities that support long-term evolution, not just immediate functional requirements.

2025 Market Timing Advantages

Current European market conditions create favorable opportunities for TMS procurement negotiations. The Upply x Ti x IRU European road freight rates index for Europe shows that Q1 2025 contract rates fell by 2.3 points quarter on quarter (q-o-q). Spot rates declined more sharply, 3.8 points q-o-q, indicating reduced demand pressure that extends to software procurement.

Platform vendors are increasingly competitive as the market consolidates. Cloud democratization is driving growth in the SME segment, with SaaS TMS solutions expected to continue expanding through 2030. This creates opportunities for better pricing and terms, especially for multi-year commitments.

The strategic timing considerations:

Regulatory Readiness Premium

Platforms with built-in CSRD and eFTI compliance capabilities command premium pricing now but save significant customization costs later. Factor this into TCO calculations when comparing solutions.

Market Consolidation Opportunities

Mid-tier vendors are aggressively pricing to maintain market share. This creates opportunities for sophisticated buyers to secure favorable terms on capable platforms.

Technology Maturity Advantages

Cloud TMS platforms have reached operational maturity, reducing implementation risk compared to earlier generations. Established providers like Cargoson, Transporeon, and Descartes offer proven integration patterns that reduce customization requirements.

The market timing lesson? 2025 presents a window for strategic TMS investments that establish regulatory-ready infrastructure before compliance deadlines create urgency and reduce negotiating leverage.

Your TMS Total Cost of Ownership model should reflect this reality: comprehensive upfront planning and implementation investment that positions your organization for the next decade of operational excellence and regulatory compliance. The alternative—reactive, budget-constrained implementations—inevitably costs more and delivers less value over time.