TMS Vendor Consolidation Wave: What European Procurement Teams Need to Know Before Their Next Software Selection

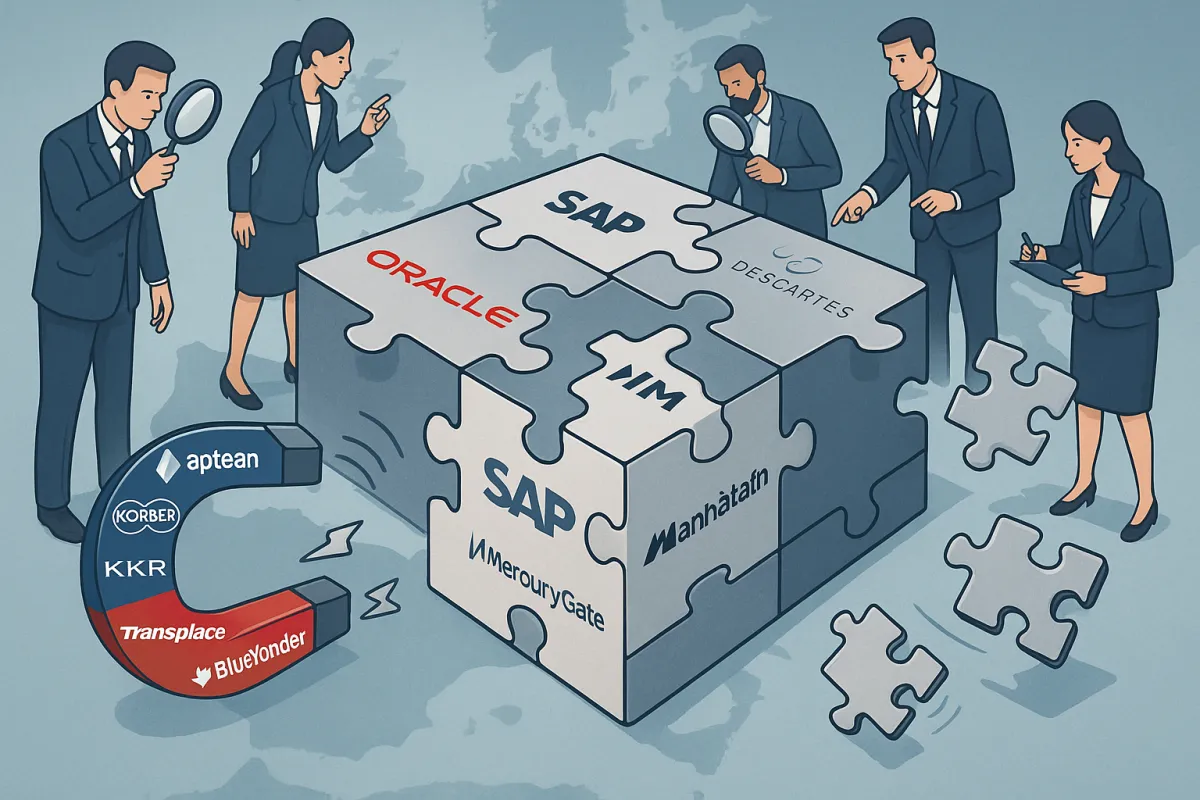

The transport management software market is experiencing a historic consolidation wave that's fundamentally altering vendor selection dynamics for European procurement teams. The top 5 TMS providers hold just 17% of the global market share, but that number masks an aggressive acquisition spree that's rapidly concentrating power among fewer players.

Recent months have delivered a series of major deals reshaping the competitive landscape. Aptean announced its acquisition of 3T Logistics & Technology Group, a company offering cloud-based TMS solutions to European carriers and shippers, while Körber and KKR acquired MercuryGate International Inc., strengthening Körber Supply Chain Software's portfolio. These transactions signal the start of a broader industry transformation that European procurement teams can no longer ignore.

The Scale of TMS Consolidation Reshaping the Market

The numbers paint a clear picture of rapid market concentration. Transportation and logistics acquisition transactions increased 159% to $90.5 billion from $35 billion in 2023, with activity picking up significantly in the second half of 2024. This surge reflects stabilizing market conditions and renewed confidence among acquirers seeking scale advantages.

M&A activity remains brisk, with vendors acquiring telematics firms to integrate sensor data into predictive engines and snapping up freight marketplace startups for real-time rate feeds. The strategic rationale is clear: platform consolidation is driven by shipper demand for single-pane control covering order, warehouse, and transport flows.

Major players are moving aggressively to capture market share. Transplace gained significant traction following its acquisition by Uber Freight, demonstrating how acquisitions can rapidly accelerate platform capabilities. Meanwhile, Blue Yonder expanded its supply chain offerings by acquiring One Network Enterprises, creating broader end-to-end solutions that smaller vendors struggle to match.

Private Equity's Role in Driving Transport Tech Acquisitions

Private equity firms are playing an increasingly prominent role in transport technology consolidation. Private equity activity in the cybersecurity market increased after a quieter 2023, and this pattern extends to logistics technology. PE firms now consider the AI-readiness of potential acquisitions to ensure sustainability in an AI-driven market.

The financial pressure is intensifying competition for quality assets. PE firms, facing pressure to return capital, will likely pursue creative structures such as minority recaps, GP-led secondaries, and bolt-ons in AI-adjacent verticals. This dynamic creates both opportunities and risks for European shippers evaluating vendor stability.

Procurement Risks European Shippers Face

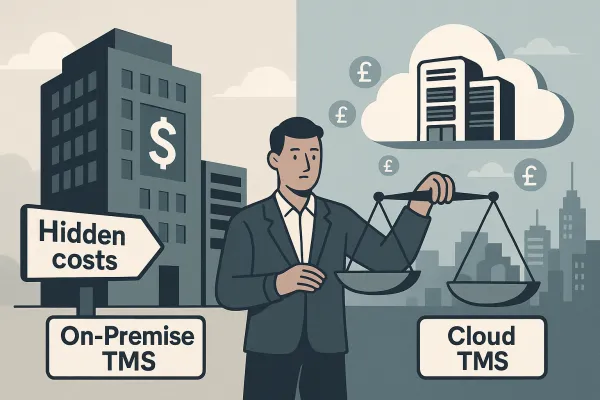

The consolidation wave introduces significant procurement risks that many European teams haven't fully considered. Market concentration is influenced by high barriers to entry, such as advanced technological capabilities and substantial capital investment, driving the market towards consolidation through mergers and acquisitions.

Vendor lock-in scenarios become more likely when acquired platforms are sunset or merged into larger ecosystems. The complexity of TMS implementations means switching costs are already high—enterprises often run heavily customized ERP and WMS platforms, pushing TMS integration projects to 6-18 months and budgets from USD 500,000 to USD 5 million. When your vendor gets acquired, you face additional migration costs and service disruptions.

Contract renegotiation triggers pose another significant risk. Acquisition events often activate change-of-control clauses, giving acquirers the right to modify pricing, support levels, and service terms. European shippers report instances where post-acquisition price increases of 20-40% became standard practice, especially when acquired solutions were integrated into larger enterprise platforms.

The upcoming eFTI compliance deadline adds urgency to these concerns. As of July 2027, the eFTI Regulation will apply in full, requiring electronic freight transport information compliance. If your TMS vendor gets acquired and their eFTI roadmap changes, you could face compliance gaps that disrupt cross-border operations.

The Independence Question in Vendor Selection

The neutrality of TMS platforms becomes questionable when carriers acquire transport management software companies. Recent integration into the WiseTech Global ecosystem—alongside Bloom Global—raises questions about long-term neutrality, as this acquisition may prove synergistic for enterprises but others might view it as a potential limitation.

Algorithm objectivity comes under scrutiny when platforms optimize routes and carrier selection while being owned by specific carriers. European shippers need to evaluate whether acquired TMS solutions maintain fair carrier network participation or subtly favor the parent company's logistics services.

Contract Protection Strategies for Consolidation Events

Smart procurement teams are building consolidation protection into their TMS contracts before signing. Key clauses should include change-of-control notifications requiring 90-day advance notice of ownership changes, with specific rights to terminate without penalty if the acquisition materially affects service delivery.

Service level maintenance provisions prevent acquirers from degrading support quality during integration periods. European shippers should negotiate minimum support staffing levels, maximum response times for critical issues, and financial penalties for SLA breaches during transition periods.

Pricing protection clauses can limit post-acquisition price increases. Consider including most-favored-nation provisions that guarantee pricing equivalent to other similar customers, plus caps on annual price increases regardless of ownership changes.

Source code escrow arrangements provide additional protection for custom integrations and configurations. If your TMS vendor stops supporting your specific implementation post-acquisition, escrow provisions ensure continued access to system modifications and customizations.

Due Diligence Red Flags in Today's M&A Environment

Financial health assessment requires deeper analysis in today's consolidation environment. Look beyond current revenue and examine debt levels, cash flow patterns, and dependency on key customers. PE-backed vendors may show strong growth but carry significant debt loads that make them vulnerable to fire-sale acquisitions.

Integration track records matter more than platform capabilities when evaluating acquirers. Research how successfully your potential vendor has absorbed previous acquisitions. Did they maintain service levels during integration? How long did system migrations take? Were there significant feature deprecations?

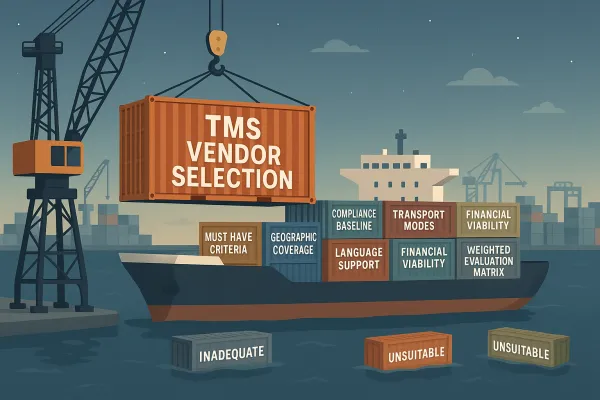

Development roadmap alignment becomes critical when vendors are actively acquiring. European-specific features like eFTI compliance and cross-border VAT handling may get deprioritized if the acquirer focuses on other regions. Demand explicit roadmap commitments with delivery timelines in your contract.

Strategic Positioning for European Procurement Teams

European procurement teams should adopt a portfolio approach that balances platform capabilities with vendor independence. Instead of selecting the single "best" TMS, consider splitting transport management across two complementary platforms—perhaps using Cargoson for European regional transport while maintaining Oracle TM for global enterprise requirements.

Regional versus global consolidation patterns create opportunities for European-focused alternatives. While US-based platforms like MercuryGate and Oracle TM pursue global scale, European solutions such as Cargoson, Alpega, and Transporeon maintain stronger focus on local compliance requirements and carrier networks.

Multi-vendor strategies reduce consolidation risk while maintaining operational flexibility. ROI proof points, such as USD 5 million in annual savings at Modern Transportation, are critical for vendor shortlists. European shippers can achieve similar results by strategically distributing transport spend across multiple platforms.

The key is matching vendor selection to operational requirements rather than following market leaders. Leading TMS providers like MercuryGate, Descartes, and Cargoson are preparing eFTI-compatible solutions, with the key being choosing platforms that combine regulatory compliance with transport optimization capabilities.

2025-2026 Procurement Calendar Adjustments

Timing TMS selections around anticipated merger announcements requires careful market monitoring. The second half of 2025 is poised to deliver steady M&A activity, with strategic acquirers doubling down on AI talent and capabilities. European procurement teams should accelerate selection processes for vendors showing acquisition signals.

eFTI compliance timeline coordination becomes essential for European operations. By September 2025, the Commission plans to adopt remaining eFTI implementing specifications, with platforms and service providers starting preparations in January 2026. Your TMS selection timeline needs to ensure eFTI readiness well before the July 2027 full implementation deadline.

Consider vendor stability alongside compliance capabilities when evaluating options. Independent European platforms like Cargoson offer more predictable roadmaps for eFTI compliance than recently acquired solutions still undergoing integration. The regulatory deadline creates both urgency and opportunity for making strategic vendor changes.

European procurement teams navigating this consolidation wave need to think strategically about vendor diversification, contract protection, and compliance readiness. The old approach of selecting market leaders and assuming stability no longer applies. Success requires balancing platform capabilities with vendor independence, building contract protections against acquisition risks, and timing selections to avoid the worst consolidation disruptions.

The TMS consolidation wave will continue accelerating through 2025-2026. Procurement teams that prepare now—with better contracts, diversified vendor strategies, and eFTI-ready solutions—will maintain competitive advantages while their competitors struggle with integration disruptions and compliance gaps.