TMS Vendor Financial Health Assessment: The European Procurement Framework That Prevents Startup Collapse and Acquisition Disruption Risks Worth €3M+ in Project Failures

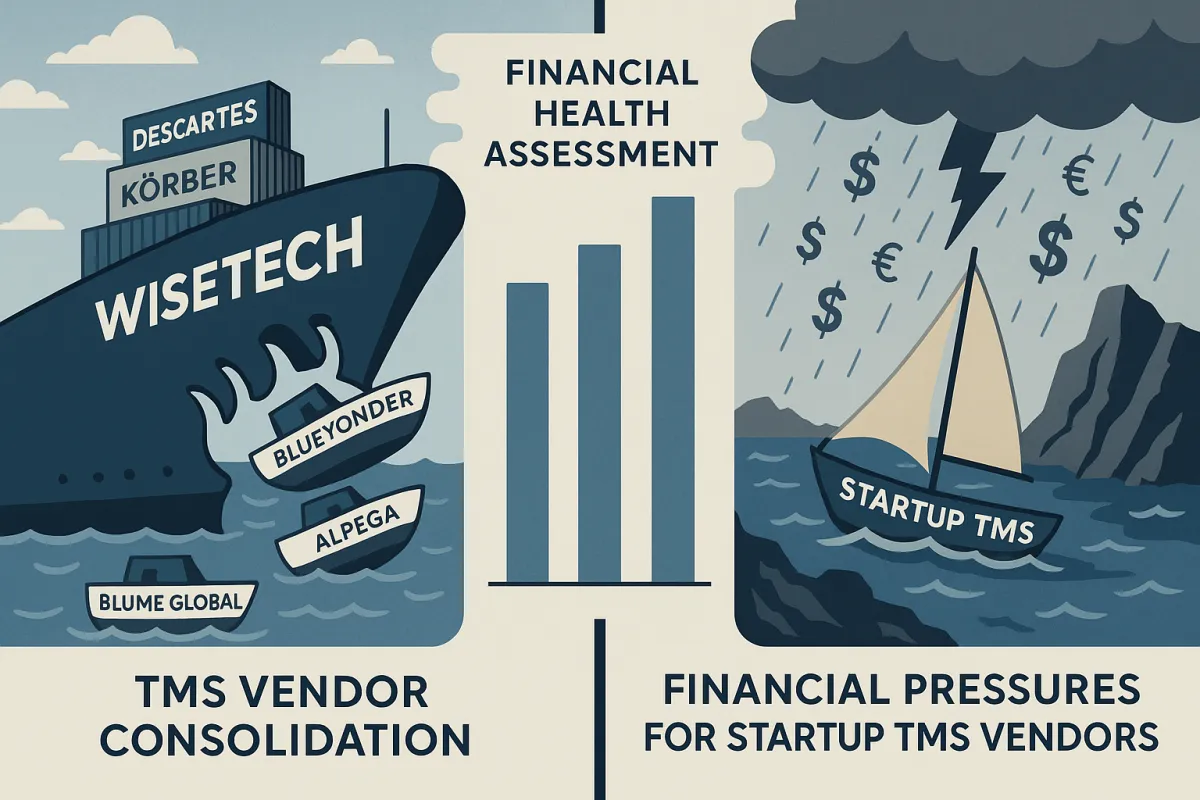

European procurement teams currently face an unprecedented challenge in TMS vendor selection. WiseTech's acquisition of E2open in 2025, Descartes' purchase of 3GTMS for $115 million in March 2025, and Körber's transformation of MercuryGate into Infios following their 2024 acquisition represent just the beginning of a fundamental market restructuring while startup TMS vendors struggle with a minimum cash buffer of $849,000 required to cover initial operating losses until reaching profitability within four months. This dual risk scenario demands a financial health assessment framework that addresses both consolidation disruption risks from established players and viability concerns from promising but financially vulnerable newcomers.

The Hidden Financial Risk Crisis in TMS Vendor Selection

The most significant TMS vendor consolidation wave in over a decade is reshaping European procurement decisions right now, eliminating choice and creating new risks for procurement teams who thought they had plenty of time to evaluate options. Meanwhile, TMS startups face severe financial pressures with initial monthly fixed running costs starting at approximately $29,000 in 2026, dominated by core engineering payroll, with CEO and Lead Software Engineer salaries totaling $22,500 monthly.

The financial instability risks are staggering. 66% of technology projects end in partial or total failure, with 17% of large IT projects threatening company existence. When your TMS vendor becomes an acquisition target or faces financial distress, you inherit these risks without directly managing them. A German automotive parts manufacturer recently discovered this reality when their €800,000 TMS implementation turned into a complete platform re-implementation after discovering their European carriers couldn't integrate without costly custom development work.

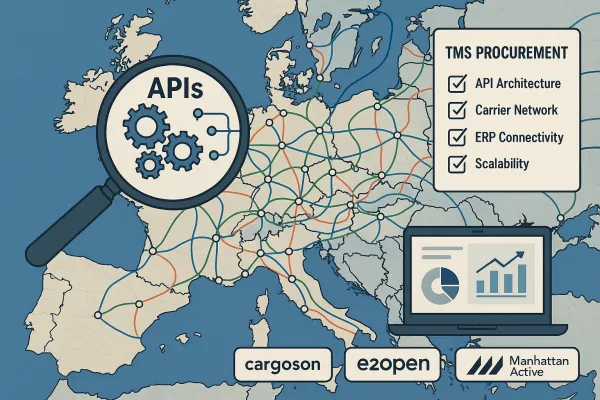

Traditional vendor assessments fail because many pre-contract due diligence solutions provide either an internal assessment or an external financial report but not both, creating risky gaps and potential exposure. European procurement teams need frameworks that can simultaneously evaluate Cargoson, nShift, Alpega, and other established providers alongside emerging solutions while assessing both acquisition risks and startup viability concerns.

Why Traditional Vendor Assessment Fails for TMS Providers

TMS startups face unique financial pressures that traditional assessment methods don't capture. Variable expenses total 200% of revenue in the first year due to high hosting and API integration costs, with cloud hosting consuming 80% of revenue in 2026. These infrastructure-heavy cost structures mean early revenue is highly leveraged against the technology stack, creating vulnerabilities that don't appear in standard financial ratios.

The problem extends beyond cash flow analysis. About 74% of startups fail due to premature scaling, which often leads to an unsustainable burn rate through new hires, facility expansions, or aggressive marketing campaigns that outpace revenue growth. For TMS providers specifically, a minimum monthly budget of $41,500 is required to cover fixed overhead and essential marketing before achieving profitability.

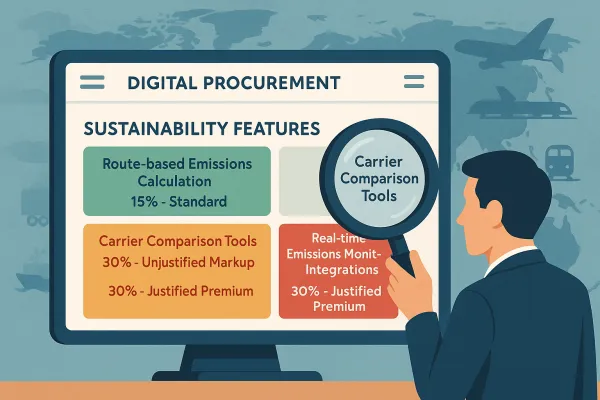

Your traditional vendor scoring may miss critical warning signs that differentiate sustainable TMS providers from those headed toward financial distress. European regulatory requirements add complexity - vendors must invest in CBAM compliance, multi-currency operations, and cross-border integration capabilities that strain cash reserves during critical growth phases.

The Five-Pillar TMS Vendor Financial Health Framework

Pillar 1: Startup Viability Indicators

Monitor monthly burn rate patterns specific to TMS operations. A startup with $2M in the bank and $400K net burn has only 5 months of runway, forcing cost cuts or weak fundraising terms. Look beyond headline numbers to understand infrastructure costs - TMS providers typically see cloud hosting costs drop from 80% to 40% of revenue by 2030 due to economies of scale.

Evaluate customer acquisition velocity against churn indicators. TMS providers with high Annual Contract Values but long sales cycles face different risk profiles than those with rapid customer onboarding. If customer onboarding takes longer than planned, churn risk rises - focus on securing high-ACV clients early on.

Calculate revenue runway projections using TMS-specific metrics. For example, if your startup has $100,000 in cash reserves and a monthly net burn rate of $10,000, your runway is 10 months, providing a quick snapshot of your financial timeline for funding or cost adjustments.

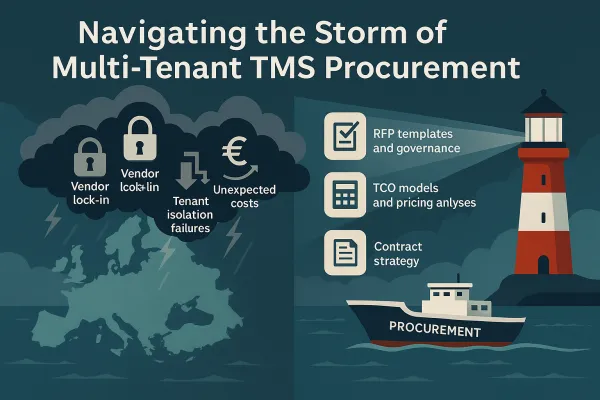

Pillar 2: Acquisition Risk Assessment for Established Vendors

Assess acquisition vulnerability patterns among TMS providers. Post-acquisition pricing changes are common outcomes, and companies undergoing integration often experience 12-18 months of reduced innovation while they harmonize platforms and teams. Vendors like Descartes, with 32 acquisitions since 2016, present different integration risks than single-acquisition players.

Evaluate the financial positioning that makes vendors attractive acquisition targets. High-growth TMS providers with strong carrier relationships and regional market dominance often attract buyer interest. Include contract language requiring 12-18 months advance notice of acquisition discussions that might impact service delivery.

Consider market positioning among major vendors. The post-consolidation landscape reveals three categories: global mega-vendors (Infios/MercuryGate, Descartes, SAP TM, Oracle TM, E2open/WiseTech), European specialists (Alpega, nShift, Transporeon/Trimble), and emerging European-native solutions (including Cargoson) that focus specifically on cross-border European operations.

Pillar 3: Real-Time Financial Monitoring

Implement continuous financial health monitoring using external data providers. Review frequency depends on vendor criticality and risk: Critical vendors should be reviewed quarterly, high-risk vendors semi-annually, standard vendors annually, and low-risk vendors every 2-3 years.

Configure automated alerts for compliance status changes and risk identification. Continuous monitoring can include periodic reviews of financial health, security protocols, compliance status, and new developments throughout the vendor relationship.

Track key financial ratios specific to TMS operations. Monitor liquidity ratios (current ratio, quick ratio), profitability ratios (net profit margin, ROA), leverage ratios (debt-to-equity, interest coverage), and efficiency ratios (asset turnover, days sales outstanding) with red flags including current ratio < 1.0, negative cash flow, debt-to-equity > 2.0, and declining revenues.

Pillar 4: European Regulatory Compliance Capacity

Evaluate vendors' readiness for upcoming European regulations as financial stability indicators. By July 9, 2027, the eFTI Regulation applies in full, while starting August 19, 2025, all heavy-duty vehicles registered in the EU operating in other Member States must be fitted with G2V2 devices. Vendors investing proactively in compliance demonstrate stronger financial planning.

Assess multi-language, multi-currency business logic capabilities as operational maturity signals. TMS providers handling cross-border European operations need sophisticated localization capabilities that require significant development investment - a positive indicator of long-term commitment and financial stability.

Review CBAM compliance readiness and carbon tracking capabilities. Vendors preparing for environmental regulations show strategic financial planning and market awareness that indicates sustainable business models.

Pillar 5: Market Position and Competitive Resilience

Evaluate competitive positioning against established players including Oracle TM, SAP TM, Blue Yonder, E2open, MercuryGate (now Infios), Descartes, Cargoson, Alpega, and nShift. Understanding how vendors compete and differentiate indicates market viability and revenue sustainability.

Assess European market commitment specifically. Geopolitical changes (Brexit), driver scarcity, and logistics talent retention present challenges, while European market fragmentation of carrier networks adds complexity that requires dedicated investment and local expertise.

Review carrier network integration depth and breadth as competitive moats that indicate both market position and switching costs for customers - positive indicators of revenue stability and growth potential.

Red Flag Early Warning System for TMS Vendors

Monitor financial solvency indicators beyond traditional metrics. Reviewing third-party financial statements is integral to TPRM programs, and identifying red flags early allows teams to mitigate risks by working with vendors to address concerns or finding alternative providers.

Watch for data migration risks and vendor dependency considerations. TMS implementations create significant switching costs, making vendor financial stability critical for avoiding forced migrations. High customer concentration or over-reliance on specific technology partnerships signal vulnerability.

Analyze operating margin patterns distinguishing sustainable growth from "buying" market share. TMS startups with cloud hosting costs at 80% of revenue face margin pressure until economies of scale develop, making burn rate monitoring essential.

Assess technical debt indicators and maintenance capacity. Vendors cutting development spending to preserve cash may compromise platform reliability and security, creating long-term risks that traditional financial analysis misses.

Implementation Checklist and Scoring Matrix

Establish risk appetite definitions and assessment scope. High-risk vendors handling sensitive data or critical services should be reviewed at least annually, while moderate or low-risk vendors need reviews every two to three years.

Develop tiered vendor assessment approaches: Critical/Sensitive vendors (single-source, essential services) requiring comprehensive financial analysis; Moderate Risk vendors needing focused assessments of specific risk areas; Low Risk vendors receiving baseline financial health checks.

Create scoring matrices weighted by vendor category and risk profile. Include comparative benchmarks using Transporeon, nShift, ShipStation, and Cargoson to establish market-relative performance expectations.

Document contract negotiation tactics leveraging financial health data. Include pricing protection clauses, acquisition disclosure requirements, and service level guarantees that protect against vendor financial distress scenarios.

Case Study: Preventing a €2.8M TMS Vendor Failure (Anonymized)

A European automotive parts distributor was evaluating three TMS finalists in early 2024. Traditional RFP scoring favored a fast-growing startup offering aggressive pricing and innovative features. However, financial health assessment revealed concerning patterns: monthly burn rate exceeding €180K with only 8 months of runway, variable costs at 250% of revenue, and customer concentration risk with their largest client representing 45% of revenue.

Warning signals that traditional procurement missed included: declining gross margins despite revenue growth, deferred platform maintenance to preserve cash, and extended payment terms to customers indicating cash flow pressure. The vendor's infrastructure costs were consuming 85% of revenue with no clear path to economies of scale.

The distributor chose an alternative vendor with stronger financial fundamentals. Six months later, the startup vendor ceased operations after failing to secure additional funding, leaving 12 customers facing emergency platform migrations. The cost avoidance calculation included: €800K implementation costs, €1.2M in operational disruption, €600K in emergency migration costs, and €200K in business continuity measures - totaling €2.8M in potential losses prevented through proper financial health assessment.

Your 90-Day Financial Health Monitoring Action Plan

Month 1: Framework Implementation and Initial Vendor Scoring

Implement the five-pillar assessment framework across your current TMS vendor portfolio. Conduct comprehensive financial health evaluations using external data providers and internal assessment capabilities. Establish baseline risk scores and identify vendors requiring immediate attention.

Month 2: Continuous Monitoring Setup and Alert Configuration

Configure automated monitoring systems for key financial indicators and compliance status changes. Deploy TPRM software and automated real-time monitoring tools to flag red flags, track vendor status changes, and maintain detailed audit records. Establish review cadences based on vendor risk levels.

Month 3: Contract Review and Risk Mitigation Strategies

Review existing contracts for acquisition protection clauses, pricing stability guarantees, and service level commitments. Negotiate enhanced terms with high-risk vendors or develop contingency plans for vendor replacement. Integrate financial health monitoring into your standard vendor management workflows.

Focus integration efforts on vendors handling critical transportation operations first, then expand to moderate-risk relationships. Implement consistent financial health review processes conducted on regular cadences, cross-collaborating with other areas of your TPRM program to preemptively mitigate identified risks.