TMS Vendor Shortlist Framework: The Procurement Template That Cuts Evaluation Time in Half

Most European procurement teams spend 18 months evaluating TMS vendors when six months would deliver the same result. The problem isn't their diligence, but their approach.

Without a structured framework, procurement teams face an exploding TMS market expected to grow four times larger between now and 2025, reaching $4.9 billion in sales. Companies using structured evaluation processes report freight savings of approximately 8 percent, with nearly 60 percent indicating less than 10 percent of net savings are absorbed by TMS costs.

Here's the procurement framework that cuts your TMS vendor shortlist process in half while improving selection accuracy.

The Hidden Cost of Poor Shortlisting

Your current shortlisting approach probably mirrors most European procurement teams: start with feature checklists, collect vendor brochures, schedule demos with anyone willing to present. This leads to late deliveries, poor quality, and vendors who looked good on paper but failed to meet standards once contracts were signed - problems that waste money, slow projects, affect compliance, and damage reputation.

The real damage happens earlier. Without elimination criteria upfront, you'll evaluate vendors that were never viable. Procurement teams must complete scoring before requirements documents go out, with vendors not seeing ratings until after submission to avoid unintended bias.

Consider this: SAP TM works brilliantly for global manufacturers but struggles with mid-market European parcel operations. Oracle excels at complex multi-modal but overwhelms simple road transport. Meanwhile, Cargoson handles mid-market European requirements efficiently but lacks enterprise-scale automation. None of this is secret, yet procurement teams regularly evaluate inappropriate vendors.

The European Compliance Layer

European TMS procurement carries regulatory requirements that North American frameworks ignore. GDPR data residency requirements mandate that personal data of EU residents must be stored and processed within specific geographic locations or under adequate safeguards to ensure compliance.

Your shortlist must address these compliance fundamentals:

eFTI Readiness: By July 2027, the eFTI Regulation will apply in full, requiring Member State authorities to accept information shared electronically by operators via certified eFTI platforms. Vendors without eFTI roadmaps create future compliance gaps.

Data Residency: Personal data can only be transferred to countries outside the European Economic Area if they provide adequate data protection, often requiring additional safeguards like Standard Contractual Clauses or Binding Corporate Rules. US-headquartered vendors without EU data centers add legal complexity.

Carbon Reporting: CSRD requirements mean TMS solutions need emissions tracking capabilities. Vendors treating this as an afterthought will struggle with upcoming disclosure mandates.

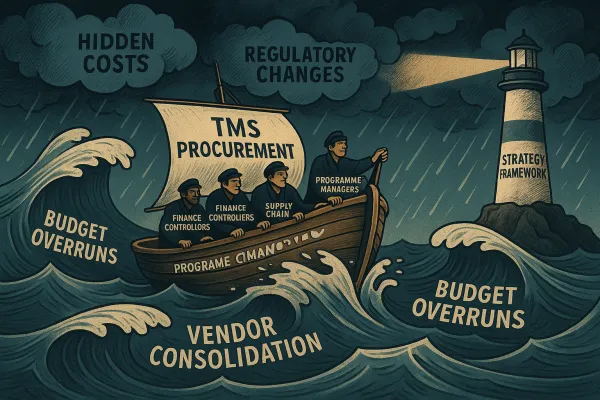

Five-Tier Shortlist Framework

This framework creates five evaluation stages, each eliminating specific vendor types:

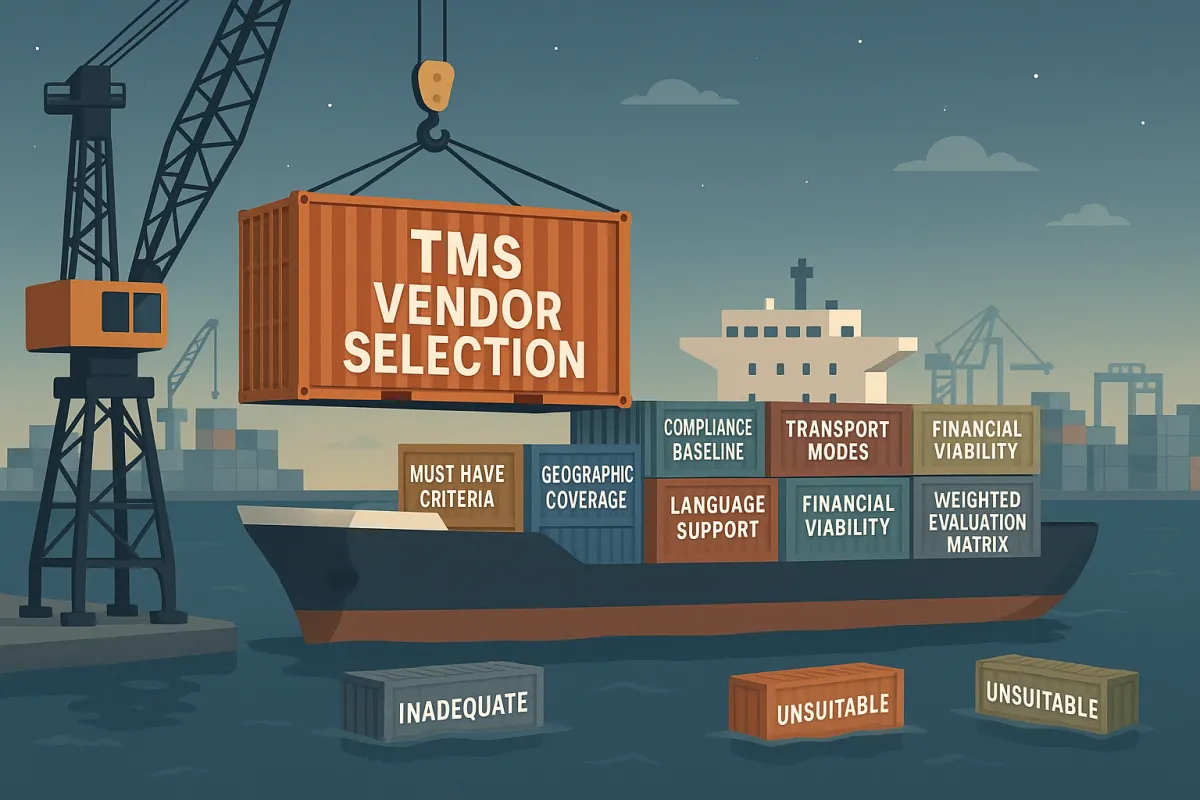

Must-Have Criteria (Elimination Round)

Organize requirements into "must-have" and "nice-to-have" categories to focus the search and evaluation process. Create a shortlist of vendors that meet basic requirements to save time by eliminating clearly unsuitable options before detailed evaluation.

- Geographic Coverage: EU operations, not just sales presence

- Compliance Baseline: GDPR compliance documentation, eFTI roadmap clarity

- Transport Modes: Your primary modes (road, rail, air, sea) with carrier integrations

- Language Support: Native support for your operating languages

- Financial Viability: Three years of audited financials or parent company backing

This stage should eliminate 60-70% of initial candidates.

Weighted Evaluation Matrix

Apply these weightings to remaining vendors:

- Functionality (30%): Core TMS features, workflow automation, reporting capabilities

- Cost (25%): Total cost of ownership over three years including hidden fees

- Implementation (20%): Timeline, resource requirements, change management support

- Support (15%): European support hours, escalation procedures, account management

- Roadmap (10%): Product development alignment with your strategic direction

The Shortlist Template in Action

Here's how the framework works with actual vendors:

High-Volume Pan-European Shipper: Requirements include multi-modal optimization, real-time visibility, and complex pricing rules.

- Advances: Descartes (strong carrier network, European presence), MercuryGate (advanced optimization), SAP TM (ERP integration)

- Eliminated: Cargoson (volume limitations), regional specialists (geographic gaps)

Mid-Market UK Distributor: Needs road transport focus, parcel integration, and straightforward implementation.

- Advances: Cargoson (European focus, rapid deployment), Alpega (road specialization), WiseTech (CargoWise integration)

- Eliminated: SAP TM (overengineered), Oracle (complexity), pure parcel providers

The most common TMS pricing model is transaction-based, using the number of shipments planned and executed through the system, offering scalability as cost is directly tied to usage and workload.

Rapid Pre-Qualification Questions

These 12 questions eliminate 60% of remaining vendors in initial calls:

- EU Data Centers: "Where is European customer data processed and stored?"

- Pricing Transparency: "Can you provide transaction-based pricing examples for our volume?"

- Implementation Timeline: "What's your typical go-live timeframe for our company size?"

- Carrier Integration: "How many carriers are integrated in our primary markets?"

- Support Model: "What support hours do you provide from European locations?"

- eFTI Readiness: "What's your eFTI compliance roadmap and timeline?"

- Reference Customers: "Can you provide three references in our industry and size?"

- Total Cost: "What additional costs should we budget beyond core licensing?"

- Change Management: "What implementation support do you provide our teams?"

- API Capabilities: "How do you integrate with ERP systems like [your system]?"

- Reporting Flexibility: "Can we build custom reports or are we limited to templates?"

- Contract Terms: "What are your standard contract length and termination provisions?"

Red Flags and Deal-Breakers

Eliminate vendors immediately if they:

- Lack EU Infrastructure: No European data centers or uncertain data residency answers

- Pricing Opacity: Pricing per document or message can range from one cent to a few cents per transaction, but shipments often trigger several or dozens of messages, drastically increasing total cost and making budgeting difficult - this model is often more expensive than anticipated

- Implementation Vagueness: Cannot provide specific timelines or resource requirements

- Limited Carrier Network: Fewer than 50 integrated carriers in your primary markets

- Poor Reference Quality: References from different industries, company sizes, or regions

- Inflexible Contracts: Only long-term contracts without pilot options

Creating Your Weighted Scorecard

Customize the basic framework for your shipping profile:

Parcel-Heavy Shippers: Increase carrier integration weighting (35%), reduce optimization scoring (20%). Prioritize vendors with strong DPD, UPS, FedEx, and national postal integrations.

Pallet-Heavy Operations: Emphasize optimization algorithms (35%) and warehouse integration (25%). Look for road transport specialists with strong dock scheduling.

Cross-Border Complex: Prioritize customs integration (30%) and multi-modal capabilities (25%). Vendors need proven customs broker connectivity and documentation automation.

European mid-market shippers should strongly consider Cargoson alongside established players. Their European focus, rapid implementation, and transparent pricing often deliver better value than oversized enterprise solutions.

The framework works because it eliminates vendors systematically rather than comparing everyone against everyone. Finding partners who can deliver on quality, reliability, and service while aligning with business goals requires a structured process from vendor sourcing to vendor evaluation to reduce risks.

Start with geographic and compliance elimination. Apply weighted scoring to survivors. Use pre-qualification questions to create your final shortlist of three vendors. This approach typically delivers better vendor selection in half the time of traditional evaluation methods.