TMS Vendor Transparency Crisis: The 2026 GDPR Enforcement Framework That Prevents €2M+ Data Processing Violations While Ensuring Operational Continuity

European Data Protection Board picked transparency and information obligations under the General Data Protection Regulation as its fifth coordinated enforcement action, launching in 2026. Your TMS procurement team now faces regulatory expectations requiring organizations to explicitly identify each third country to which personal data is transferred, while transportation data creates unique compliance nightmares.

This coordinated enforcement represents a fundamental shift in how European authorities view TMS vendor transparency. Since transparency has long been a priority for regulators, this year's action may lead to more investigations and stricter penalties than in previous years. For procurement teams managing complex vendor relationships across carriers, subcontractors, and cross-border operations, the stakes have never been higher.

The 2026 Transparency Enforcement Wave Hits TMS Procurement

The action focuses on Articles 12, 13 and 14 of the EU GDPR, which require that individuals are informed when their personal data is being processed. But here's what most procurement teams miss: transparency obligations under Articles 13 and 14 GDPR may be interpreted more stringently going forward.

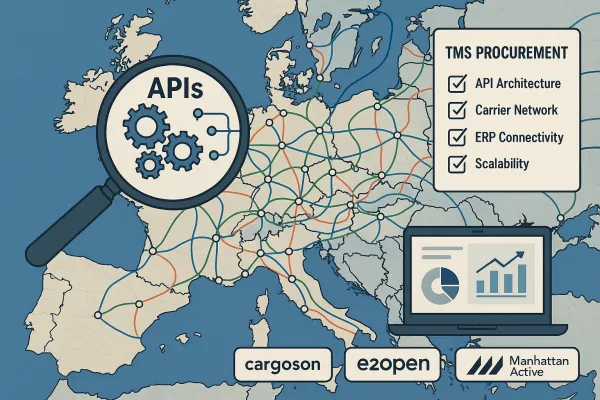

Transportation data sits at the intersection of multiple regulatory frameworks. When you're evaluating vendors like Oracle Transportation Management, SAP Transportation Management, or Cargoson, you're not just buying software. You're inheriting complex data processing relationships that span carriers, customs brokers, and freight forwarders across dozens of jurisdictions.

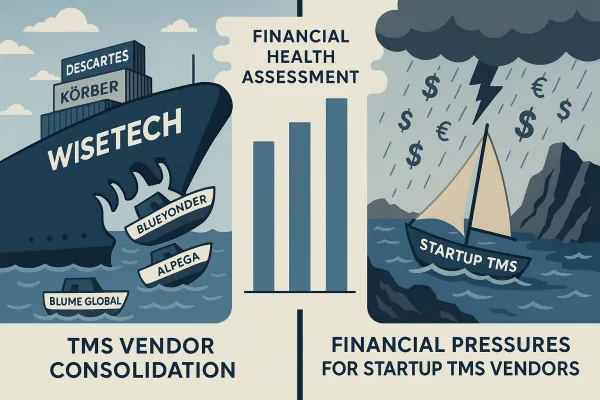

The enforcement timing creates perfect storm conditions. While major TMS providers like Descartes and MercuryGate have established compliance frameworks, companies would be well advised to conduct a targeted transparency audit, particularly where data flows are complex. This includes tracking, platforms, international service providers, and group-wide processes that characterize modern TMS deployments.

Why TMS Data Processing Creates Transparency Nightmares

Transportation management systems process some of the most complex personal data flows in enterprise software. Every shipment record contains customer addresses, driver locations, commercial invoice details, and trade lane information. When authorities require explicit disclosure of "each third country" receiving data transfers, your TMS vendor relationships become transparency minefields.

Consider a typical European shipper using a cloud-based TMS. Data flows through carrier APIs to transport providers in the UK, Turkey, and North Africa. Driver mobile apps sync location data through US-based cloud infrastructure. Customs documentation routes through third-party brokers with servers in multiple jurisdictions. Each integration point creates disclosure obligations under the new transparency requirements.

As fleets grow and automation deepens, expect a future where TMS vendors will need certifications such as ISO/IEC 27001 or even GDPR-aligned data controls for cross-border commerce. The procurement challenge? Most existing TMS contracts don't provide the granular transparency documentation you'll need to survive 2026 audits.

The Hidden Cost of TMS Transparency Failures

GDPR penalties have reached devastating levels. By January 2025, the cumulative total of GDPR fines has reached approximately €5.88 billion, with individual penalties hitting massive scales. Meta received a record-breaking €1.2 billion fine for transferring data collected from Facebook users in the EU/EEA to the US, while TikTok was fined €530 million after discovering that personal data belonging to European users had been stored on and accessed from servers in China.

Transportation companies aren't immune. Amazon Road Transport was fined by the Spanish data protection agency AEPD after requiring truck driver contractors to provide criminal record certificates and consent to data transfers to group companies and suppliers outside the European Economic Area, with AEPD determining these certificates were personal data.

GDPR establishes maximum penalties reaching up to 4% of annual global turnover, with higher tier violations including basic processing principles violations and unlawful processing or lack of legal basis. For a €500 million logistics company, maximum penalties could exceed €20 million before considering reputational damage and operational disruption.

The transparency enforcement creates additional liability layers. Traditional contract terms shifting GDPR responsibility to vendors won't protect you when authorities require detailed disclosure of your data processing arrangements. You'll need documented evidence of every data transfer mechanism, subprocessor relationship, and cross-border data flow.

The TMS Vendor Transparency Assessment Framework

Building transparency compliance requires systematic vendor evaluation beyond standard RFP processes. You should conduct a data inventory and mapping exercise to identify the sources, types, and volumes of data that your TMS collects and processes, document the data flows and transfers within and outside your organization, and the purposes and legal bases for them to determine the data privacy risks and obligations.

Your vendor assessment must capture four critical transparency dimensions. First, establish comprehensive data processing inventories. Most TMS vendors can't provide complete subprocessor lists or detailed data flow documentation. Demand real-time visibility into every third-party integration, carrier API connection, and cross-border data transfer.

Second, evaluate cross-border transfer mechanisms. Standard Contractual Clauses aren't sufficient without additional safeguards. Even commonly used mechanisms like SCCs are no longer sufficient without additional context-specific safeguards, with real-world enforcement making the risks tangible and showing that legal tools must be paired with operational and technical controls.

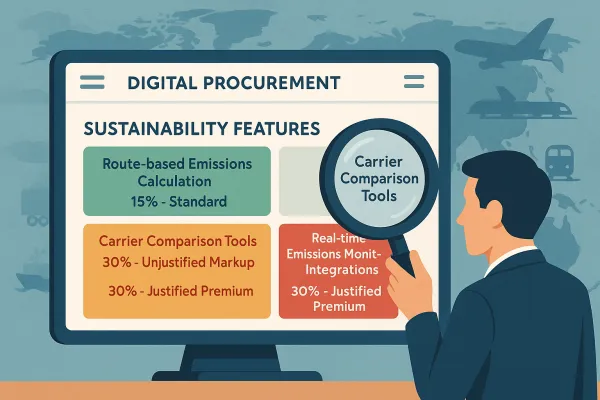

Third, assess vendor transparency capabilities. Leading solutions like Cargoson provide built-in compliance reporting, while traditional vendors like Blue Yonder and nShift often require extensive customization for transparency documentation. Compare how each vendor handles disclosure obligations for carrier integrations, API third-party connections, and data residency requirements.

Fourth, establish ongoing monitoring frameworks. Supervisory authorities are expected to use standardized questionnaires to survey the status of transparency measures at many organizations. Your TMS vendor must provide audit-ready documentation that supports regulatory inquiries without operational disruption.

Critical Vendor Questions That Expose Transparency Gaps

Standard TMS RFPs don't capture transparency compliance risks. Your vendor evaluation must include specific questions that reveal data processing gaps:

For subprocessor transparency, ask: "Provide a complete, real-time accessible list of all subprocessors with access to personal data, including carrier API partners, cloud infrastructure providers, and support vendors. How do you notify customers of subprocessor changes?" Many vendors can't provide comprehensive answers.

For cross-border transfers, demand: "Document all countries where personal data is processed, stored, or accessed, including temporary caching and backup locations. What specific safeguards protect each transfer?" Some authorities have taken the position that organizations should explicitly identify each third country to which personal data is transferred.

For carrier data sharing, require: "Explain how personal data is shared with transportation providers, including access controls, retention periods, and deletion procedures. How do you ensure carrier compliance with GDPR obligations?" This reveals whether vendors have enforceable data processing agreements with carrier networks.

For transparency automation, ask: "How do you automate disclosure obligations and data subject rights responses? Can you provide audit trails for all data processing activities?" Manual compliance processes won't survive 2026 enforcement intensity.

Building TMS Vendor Data Processing Documentation

Effective transparency compliance requires comprehensive documentation that exceeds traditional contract terms. For legal and compliance teams, addressing cross-border transfer risk starts with visibility, as it is impossible to mitigate what is not documented.

Your documentation framework must include detailed data processing agreements that specify every type of personal data processed, all processing purposes and legal bases, complete subprocessor lists with update notification procedures, and comprehensive transfer impact assessments for cross-border data flows.

Establish real-time monitoring capabilities that track data processing activities, maintain audit logs for regulatory inquiries, and provide automated disclosure responses. TMS can use various monitoring and auditing tools and techniques, such as logs, alerts, reports, or dashboards, to oversee data activities.

Create incident response procedures that handle data subject requests, breach notifications, and regulatory inquiries within required timeframes. You should be prepared to respond to any data breaches or incidents promptly and effectively, and notify the relevant authorities and stakeholders as required.

Document vendor performance metrics that demonstrate ongoing compliance, including subprocessor management, data minimization practices, and security incident response capabilities. This evidence becomes crucial during transparency audits.

The 2026 TMS Procurement Transparency Checklist

Implement this compliance framework immediately to prepare for coordinated enforcement:

Pre-Selection Vendor Screening: Eliminate vendors that cannot provide comprehensive subprocessor lists, detailed cross-border transfer documentation, or real-time transparency reporting capabilities. Focus on solutions with built-in compliance features.

Contract Requirements: Include specific transparency obligations in all TMS agreements. Require vendors to maintain current data processing documentation, provide automated disclosure responses, and notify you of any subprocessor changes within 30 days.

Implementation Governance: Establish joint transparency compliance reviews with your TMS vendor. Schedule quarterly assessments of data processing activities, subprocessor relationships, and cross-border transfer mechanisms.

Ongoing Monitoring: Deploy continuous compliance monitoring that tracks vendor data processing changes, carrier integration updates, and cross-border data transfer modifications. Maintain audit-ready documentation for regulatory inquiries.

Compare vendor capabilities systematically. Traditional providers like Transporeon and FreightPOP often require extensive customization for transparency compliance, while newer solutions like Cargoson integrate compliance reporting into core functionality.

Early Warning Signs Your TMS Vendor Will Fail 2026 Transparency Requirements

Recognize these red flags during vendor evaluation that indicate transparency compliance risks:

Vague Data Processing Descriptions: If vendors can't specify exactly what personal data they process, where it's stored, or how it's transferred, they're unprepared for transparency obligations. Avoid vendors who provide generic privacy policies instead of detailed data processing documentation.

Unclear Subprocessor Policies: Warning signs include refusing to provide complete subprocessor lists, claiming "commercial sensitivity" prevents disclosure, or offering only periodic updates rather than real-time visibility into data processing relationships.

Resistance to Transparency Audits: Vendors who limit audit rights, restrict access to data processing records, or require extensive notice periods for compliance reviews lack the infrastructure to support 2026 transparency requirements.

Manual Compliance Processes: If vendors rely on manual responses to data subject requests, maintain spreadsheet-based subprocessor tracking, or require custom development for transparency reporting, they won't scale to meet enforcement demands.

These warning signs predict expensive compliance failures. Since transparency has long been a priority for regulators, this year's action may lead to more investigations and stricter penalties than in previous years. Choose vendors with automated transparency capabilities and comprehensive data processing documentation.

The 2026 transparency enforcement represents a fundamental shift in TMS vendor accountability. Those who refine their approach now will not only strengthen compliance, but also trust and efficiency in dealing with data subject rights. Start your vendor transparency assessment immediately. The coordinated enforcement action launches in months, not years.