ERP-Native TMS vs Standalone: The European Procurement Framework That Prevents €500K+ Integration Disasters in 2026's Evolving Market

European procurement teams face a crossroads that will define their transport operations for the next decade. ERP providers are reasserting themselves in the TMS space, giving companies more to consider as they evaluate options for 2026. The global transport management system (tms) market stood at USD 53.5 Billion in 2026 and maintaining a strong growth trajectory to reach USD 103.2 Billion by 2035, yet the integration between ERP and standalone TMS solutions continues to create costly disasters that can exceed €500,000 when procurement teams misunderstand the complexity.

The market consolidation happening right now makes this decision more crucial than ever. WiseTech's acquisition of E2open in 2025, Descartes' purchase of 3GTMS for $115 million in March 2025, and Körber's transformation of MercuryGate into Infios following their 2024 acquisition represent just the beginning of a vendor landscape that's shrinking while complexity increases.

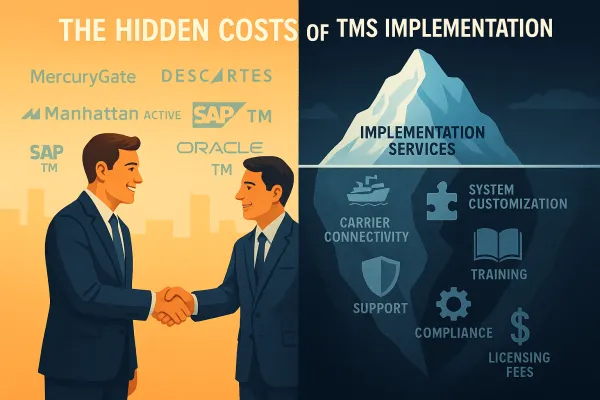

The True Cost Reality: Integration vs Native Solutions

The numbers procurement teams see in vendor presentations rarely tell the complete story. Basic API integrations cost €5,000-€15,000, while complex ERP connections exceed €50,000. Implementation costs range from €30,000 to €900,000, and for shippers with freight spend exceeding $250M annually, implementation can cost 2-3 times the subscription fee.

A German automotive parts manufacturer recently discovered why these hidden costs matter. Six months into deployment, they found their European carriers couldn't integrate without costly custom development work - turning their "smart procurement decision" into a complete platform re-implementation. Their €800,000 mistake highlights why procurement teams can't treat TMS selection as just another software purchase.

ERP-native TMS modules promise lower integration costs, but this comes with significant trade-offs. Licensed TMS software runs $50,000-$400,000+ with annual maintenance charges ranging from 15-20% of license costs. For a 100-truck operation, that initial $100,000 investment becomes $200,000+ in the first year when you factor in implementation, training, and infrastructure requirements.

Integration Complexity Assessment Framework

The integration challenge goes deeper than simple API availability. Many interfaces between TMS and ERP systems require custom-developed transformations and processing. A basic domestic shipper needs 10-15 integrations minimum, totaling 1,000-1,500 hours of labor, while most shippers today require an average of 40 integrations. Some complex implementations record over 140 integration objects.

Teams often discover they lack the necessary licenses or modules for API connectivity only after contracts are signed. European companies typically need to integrate their TMS with existing ERP systems (SAP, Oracle), WMS platforms, and carrier APIs. A pharmaceutical distributor in the Netherlands spent an extra €180,000 because their chosen TMS couldn't handle their complex lot tracking requirements without custom development.

Cloud-native platforms like Cargoson offer pre-built integrations with European carriers, while enterprise solutions from MercuryGate and Descartes typically require more extensive customization work. The integration timeline varies significantly: 1-3 months for well-architected systems versus 6-18 months for complex legacy environments.

European Market Realities: Regulatory and Operational Demands

European shippers face regulatory complexity that most ERP-native TMS modules weren't designed to handle. Since January 2024, the European Union's Emissions Trading System has required verified carbon emissions reporting for all cargo and passenger vessels over 5,000 gross tons visiting EU ports. This development forces shippers to gather, monitor, and annually report their emissions, with regulatory coverage expected to increase from 40% in 2024 to full compliance by 2026.

The eFTI Regulation adds another layer of complexity. The regulation affects road, rail, inland waterway, and air transport, meaning your entire multimodal network needs preparation. As of 9 July 2027, the eFTI Regulation will apply in full, requiring QR code generation and machine-readable format capabilities that many ERP-native TMS modules lack.

Purpose-built TMS solutions typically offer stronger European carrier connectivity and freight management capabilities. Cargoson offers direct API/EDI integrations with carriers across all transport modes, while Transporeon connects 150,000+ carriers but many integrations are standard EDIs or PDF/email transmissions rather than true API connections. Enterprise platforms like Oracle TM and SAP TM provide comprehensive functionality but often struggle with the specific requirements of European mid-market shippers.

The Vendor Lock-in Risk Assessment

ERP-native TMS creates deeper integration but limits flexibility for future changes. Companies undergoing integration often experience 12-18 months of reduced innovation while they harmonize platforms and teams. When vendor consolidation accelerates, procurement teams with ERP-native solutions have fewer exit options.

Contract negotiation leverage varies significantly between ERP and TMS vendors. ERP vendors typically hold more organizational influence through their broader system footprint, making it harder to negotiate TMS-specific terms. Standalone TMS providers often offer more flexible contract structures and competitive pricing pressure.

Decision Matrix: When to Choose ERP-Native vs Standalone

The decision framework depends on several key factors that procurement teams need to evaluate systematically:

Choose ERP-native TMS when: Your organization has strong ERP governance, limited IT resources for multiple vendor management, and primarily domestic transport operations. Companies with freight spend under €50M annually often benefit from the simpler vendor relationship and reduced integration complexity.

Choose standalone TMS when: You need specialized European carrier connectivity, complex multimodal operations, or advanced freight management features. Modern transport tender management through TMS platforms can reduce procurement cycle times by 60% while delivering measurable cost savings. But European manufacturers should track broader integration benefits beyond immediate freight savings. Primary financial metrics include direct transport cost reduction, administrative cost savings from eliminated manual processes, and inventory optimization through improved delivery predictability.

Company size thresholds matter significantly. High initial deployment costs hinder adoption, with 47% of SMEs reporting financial limitations in implementing advanced TMS solutions. Mid-market European shippers often find solutions like Cargoson, nShift, or Manhattan Active TM provide better feature-to-cost ratios than ERP-native alternatives.

Procurement Governance Framework

Integration with adjacent systems, such as WMS, ERP, and supply chain planning, has become a key differentiator, enabling end-to-end visibility and faster response to disruption. Success requires coordinated stakeholder management across IT, finance, operations, and logistics teams.

Establish clear decision criteria that address both immediate needs and future flexibility. API-first architecture requirements protect against platform changes by ensuring your integrations don't depend on proprietary connections that may be deprecated during vendor consolidations. Specify open API standards and require documentation that enables third-party integration development.

Contract negotiation strategies should account for the ongoing vendor landscape changes. Include data portability clauses, integration support commitments, and regulatory compliance update guarantees in all agreements.

2026 Market Outlook: Strategic Positioning

The market dynamics shaping procurement decisions will intensify throughout 2026. The 2025 Transportation Management System (TMS) Technology Value Matrix reflects a market defined by rapid innovation, consolidation, and the widespread application of AI across logistics execution. Persistent volatility in global trade, labor shortages, and capacity constraints continue to drive organizations toward platforms that unify planning and execution while optimizing cost and service.

AI dominated transportation discussions in 2025, and Hamilton expects that to continue. The technology investments ERP providers are making in AI and automation will likely strengthen their TMS offerings, but this development timeline creates procurement windows for organizations willing to move decisively.

European regulations will continue driving TMS requirements. These environmental mandates are boosting demand for strong carbon accounting and reporting features within TMS solutions. Leading TMS vendors are now adding standardized emissions-tracking modules aligned with globally recognized frameworks like the GLEC Framework and ISO 14083 to support regulatory compliance and emissions transparency.

Smart procurement teams will position themselves to benefit from market consolidation rather than become victims of it. Multi-vendor strategies can provide insurance against individual vendor risks, though they require more complex integration management. Consider core TMS functionality from your primary vendor with specialized modules (carbon tracking, customs management, carrier connectivity) from best-of-breed providers that integrate via APIs.

The companies that thrive in this evolving landscape will be those that treat their TMS procurement as strategic architecture decisions rather than simple software purchases. Whether you choose ERP-native integration or standalone solutions, success requires comprehensive cost modeling, robust integration planning, and contracts that protect against the risks inherent in a rapidly consolidating market.