TMS Budget Planning 2026: How European Procurement Teams Can Navigate Mega-Deal Market Consolidation and Hidden Cost Escalation

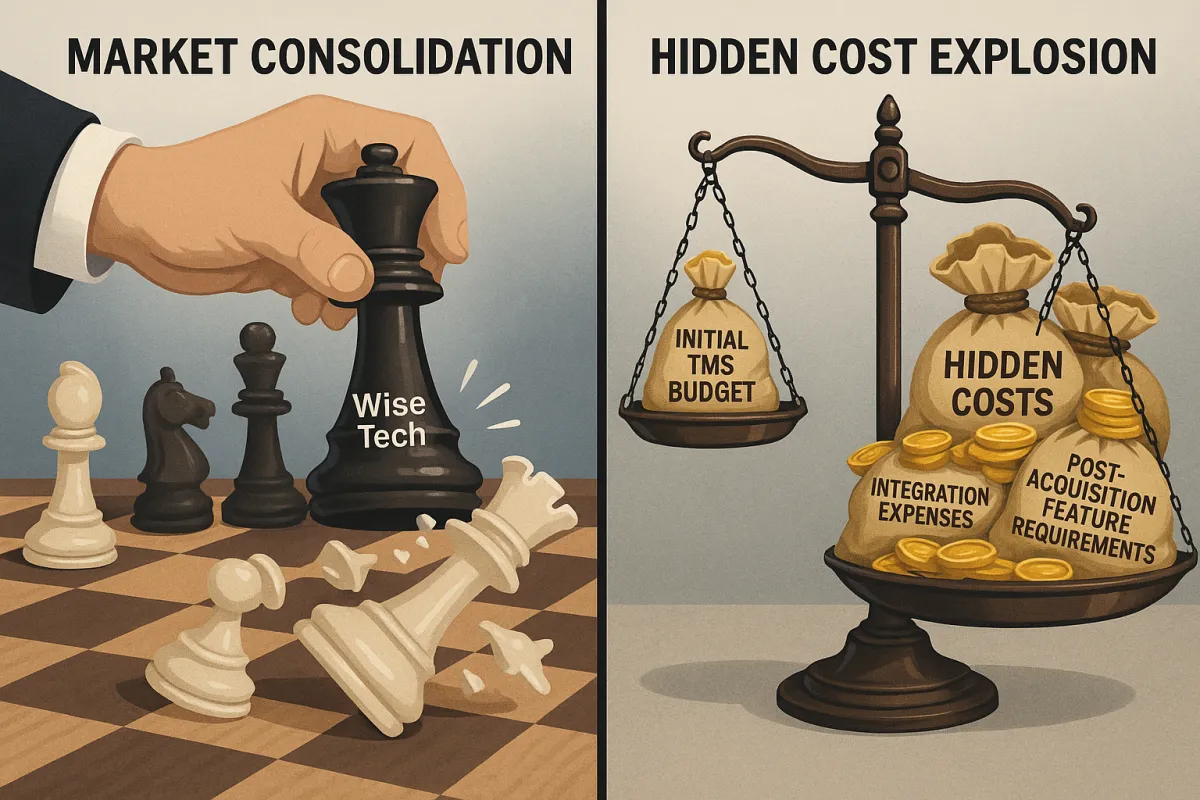

European procurement teams planning their TMS budget planning for 2026 face an unprecedented challenge: the landscape they're planning for no longer exists. WiseTech's $2.1 billion acquisition of E2open and Descartes' $115 million purchase of 3GTMS in March 2025 signal the start of a consolidation wave that will reshape vendor pricing, implementation complexity, and long-term total cost of ownership calculations.

Hidden costs consistently add 25-30% more than initial estimates, turning smart investments into budget disasters. When you combine this reality with mega-deal market consolidation eliminating vendor choice, traditional budget models become dangerously inadequate for 2026 planning.

The Great TMS Consolidation: Why Traditional Budget Models Are Failing European Teams

The European TMS market, valued at €1.4 billion in 2024 and growing at a compound annual growth rate of 12.2 percent, is forecasted to reach €2.5 billion by 2029. This growth is happening alongside unprecedented consolidation that's eliminating choice and creating new risks for procurement teams.

The scale of these acquisitions changes everything. Körber Supply Chain Software's acquisition of MercuryGate International Inc. was one of the largest in the supply chain software industry this year, adding approximately 25 percent to Körber Supply Chain Software's annual net revenue, creating what's now known as Infios. This wasn't just software acquisition - it represented strategic moves to integrate OMS, WMS, and TMS functionalities into comprehensive platforms.

What most procurement teams miss: these aren't just financial transactions. Product roadmap uncertainties are already surfacing. When two TMS platforms merge, customers inevitably face decisions about which system to standardize on, what features will be deprecated, and how long dual support will continue.

The urgent reality? Your next TMS decision may be your most important transport technology choice of the decade. Choose carefully, but don't delay. The vendor landscape will look dramatically different by 2026.

The Hidden Cost Explosion: What Mega-Deals Really Mean for Your 2026 Budget

Post-acquisition pricing changes follow predictable patterns. License fees represent just the starting point. TMS implementation costs range from €30,000 to €900,000, depending on complexity and vendor approach. But consolidation amplifies these costs through several mechanisms.

First, cost structures increasingly favor enterprise accounts. Traditional TMS systems cost €100,000+ annually and take months to install, while modern cloud platforms offer faster deployment and transparent pricing. Some traditional systems require €100,000+ annual commitments, while others offer usage-based models.

Integration complexity explodes after acquisitions. Transaction-based pricing quotes typically exclude integration expenses. Basic API integrations cost €5,000-€15,000, while complex ERP connections exceed €50,000. For shippers with annual freight under management exceeding €250M, implementation costs often run 2-3x the subscription fees.

The mathematics become stark: what started as a €100,000 annual software investment transforms into €200,000+ first-year total cost once you factor in integration complexity, carrier connections, and post-acquisition feature requirements that weren't needed before the merger.

Post-Acquisition Feature Bloat and Pricing Changes

E2open's recent integration into the WiseTech Global ecosystem alongside Bloom Global raises questions about its long-term neutrality. For enterprises, this acquisition may prove synergistic, but others might view it as a potential limitation.

European manufacturers discover this reality during implementation. A German automotive parts manufacturer discovered six months into their TMS implementation that they'd made an €800,000 mistake. Six months in, €800,000 spent, and they realized their new system couldn't handle their complex carrier network across 12 countries.

The 2026 European Procurement Framework: Building Consolidation-Proof Budget Models

Your budget planning process must account for vendor instability as a core risk factor. Start with financial stability assessment beyond current revenue figures. The transaction's success hinges on the ability to realize synergies, navigate integration challenges, and capitalize on the accelerating consolidation of supply chain technology. While challenges remain, the potential rewards are substantial.

Specify open API standards in all vendor discussions. Traditional vendor lock-in becomes exponentially more risky when your chosen platform gets acquired by a competitor or private equity firm with different strategic priorities. Require documentation proving API-first architecture and clear data portability guarantees.

5-Year TCO Modeling in a Consolidating Market

Build your TCO model using these realistic allocations: license fees (20-30%), implementation services (25-40%), carrier integration (15-25%), customization and training (10-20%), and ongoing support (15-20%). These percentages shift dramatically when vendors merge and rationalize product lines.

Multi-vendor strategies provide essential risk mitigation. Instead of betting everything on one comprehensive platform, consider core TMS functionality with specialized modules from best-of-breed providers. This approach protects against post-acquisition product discontinuation while maintaining competitive pricing leverage.

Regulatory Compliance as Budget Driver: eFTI, CBAM, and Beyond

European regulatory compliance requirements add another layer of budget complexity. As of 9 July 2027, the eFTI Regulation will apply in full. Member State authorities must accept electronic information via certified eFTI platforms starting July 9, 2027. This isn't optional - it's mandatory for freight operators wanting to avoid paper documentation burdens during inspections.

eFTI readiness requires more than basic electronic documentation. Your TMS selection directly impacts eFTI readiness. Business data must be housed on secure, certified IT platforms that integrate with existing data management systems. Not every TMS vendor offers native eFTI functionality. Some require third-party platform connections - adding integration costs and ongoing fees.

CBAM will apply in its definitive regime from 2026, with a transitional phase of 2023 to 2025. Importers and indirect customs representatives can apply for the status of authorised CBAM declarant to be able to import CBAM goods from 1 January 2026. As of 1 January 2026, only registered declarants will be allowed to import CBAM goods.

Budget separately for compliance features versus add-on modules. From 1 January 2026 the CBAM will mandatorily require independent verification of CBAM reports. Your TMS should automatically generate audit-ready documentation, not require manual compilation for verification.

Vendor Selection Strategy: Navigating the Post-Consolidation Landscape

Start vendor evaluation with financial stability assessment. Challenges include cultural integration, regulatory hurdles in key markets, and e2open's recent financial struggles, which could delay the mid-2026 closing and impact short-term performance. Understanding how acquisitions impact cash flow, development priorities, and customer service capacity becomes essential due diligence.

When evaluating options, consider the established players: Oracle, SAP, Manhattan, Blue Yonder alongside emerging European options like Cargoson. Position established vendors (Manhattan, SAP) alongside emerging European solutions (Cargoson, nShift) in your evaluation.

Focus on vendors demonstrating consolidation-resistant strategies. Local development teams mean faster response to European regulatory changes. When eFTI requirements or carbon reporting standards change, European-native vendors can typically deploy updates within weeks rather than the months or quarters required by global platforms.

Contract Negotiation Tactics for Uncertain Vendor Futures

Include specific clauses addressing acquisition scenarios: pricing protection for 24 months post-acquisition, guaranteed product support timelines, and data portability requirements. Watch for these warning signs during procurement: reluctance to provide detailed cost breakdowns, vague implementation timelines, limited references in your industry vertical, and unclear change request processes.

Budget Allocation Framework: Practical 2026 Planning Template

Your 2026 budget template needs separate line items addressing consolidation impacts. Start with immediate action items for Q1 2026 budget planning:

Software Licenses: Allocate 15-25% more than vendor quotes to account for post-acquisition pricing adjustments. Cloud TMS pricing ranges from $1.00 to $4.00 per freight load booked in the system. For many European shippers, this translates to predictable monthly costs that scale with business growth rather than fixed infrastructure investments.

Implementation Services: Budget 2-3x initial vendor estimates. Some TMS implementations took 18 months instead of 6. Others required expensive customizations not included in initial budgets.

Compliance Costs: Your downloadable TCO template should include separate line items for eFTI compliance costs, whether built into transaction fees or charged separately. Some require third-party platform connections - adding integration costs and ongoing fees. Companies selecting TMS solutions now must evaluate eFTI compatibility as a core requirement.

Integration Expenses: A basic domestic shipper requires 10-15 integrations minimum, potentially totaling 1,000-1,500 hours of labor. More complex operations may need 140+ integration objects.

Build scenario planning for vendor acquisition impacts. What happens if your chosen vendor gets acquired during implementation? What if their product roadmap changes mid-project? These aren't theoretical risks anymore.

Future-Proofing Your Investment: What 2027-2029 Could Bring

Additional acquisitions appear likely as private equity seeks market share consolidation. As we reported earlier this year, the logtech market remains a target for ongoing investment and ownership changes. This acquisition fits that pattern, but its scale and complexity make it a defining moment for both companies. Only time will tell whether WiseTech can successfully navigate these challenges.

Your procurement strategy must account for ongoing landscape changes. Build contract terms that protect against product discontinuation, pricing volatility, and support degradation. Require vendor roadmap transparency and minimum development commitments.

Exit strategy planning becomes essential. Specify data portability requirements, export formats, and transition assistance in all vendor agreements. Your TMS procurement success depends on understanding these hidden costs upfront. European shippers who invest time in comprehensive TCO analysis avoid the budget disasters that plague hasty implementations.

Building internal capabilities versus vendor dependence provides long-term protection. Invest in transport management expertise within your team. When vendors consolidate or change direction, internal knowledge becomes your competitive advantage.

The consolidation wave reshaping the transport management software budget 2026 landscape demands new procurement approaches. European teams that adapt their budget planning to account for mega-deal impacts, regulatory compliance requirements, and hidden cost escalation will maintain competitive advantage. Those clinging to traditional vendor evaluation methods risk expensive mistakes in an increasingly concentrated market.

Start your 2026 budget planning now. The vendors with genuinely transparent pricing and consolidation-resistant strategies will welcome detailed TCO analysis. The others will reveal themselves through their reluctance to address these new realities.