TMS Budget Reality Check: The €200K Hidden Cost Framework That European Procurement Teams Can't Afford to Ignore

European procurement teams are discovering a harsh reality: their TMS budget calculations are missing over half the true costs. A mid-sized German automotive parts manufacturer thought their TMS implementation was going smoothly. Six months in, €800,000 spent, and they realized their new system couldn't handle their complex carrier network across 12 countries. Notice the pattern? This company joins 76% of logistics transformations that fail to achieve their performance objectives.

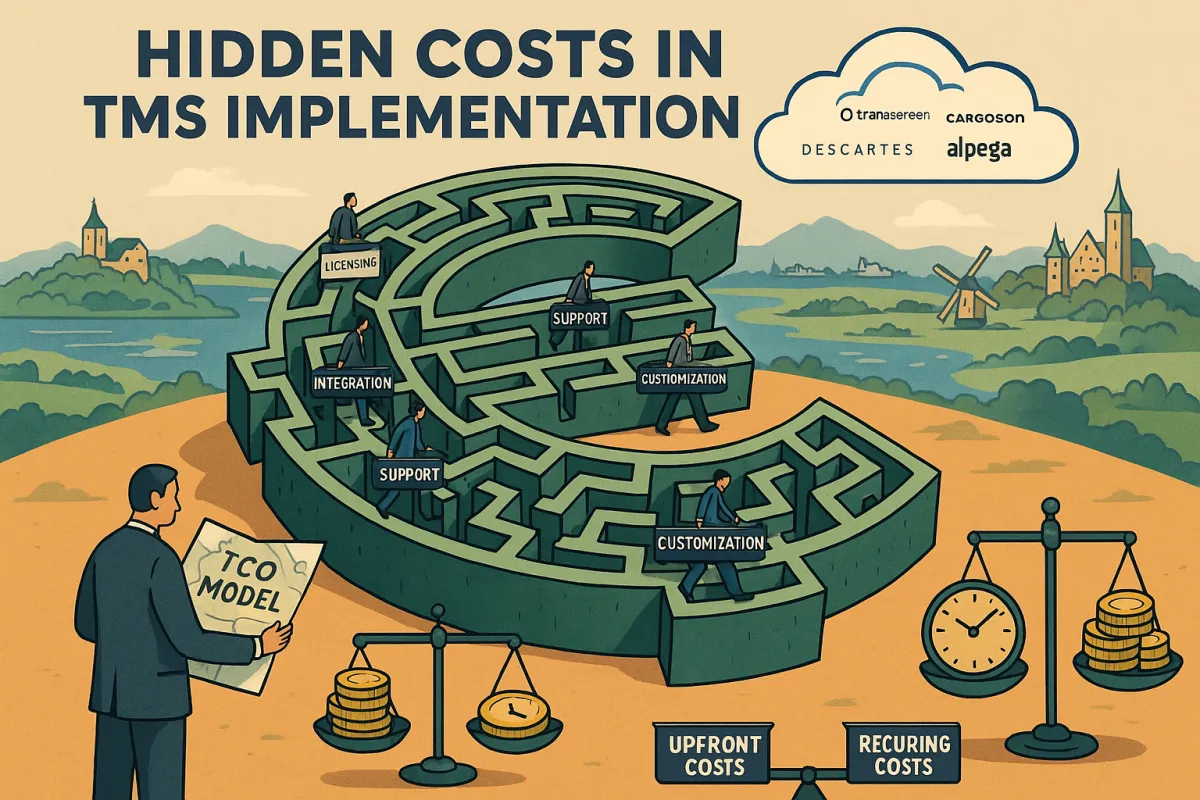

Hidden costs in TMS procurement consistently add 25-30% more than initial estimates, turning what looked like smart investments into budget disasters. The problem goes beyond simple miscalculation. While your team focuses on feature comparisons and license fees, the real financial impact lives in implementation complexity, carrier integration charges, and ongoing maintenance expenses that vendors rarely discuss upfront.

The Seven Hidden Cost Categories That European TMS Projects Can't Escape

TMS implementation costs range from €30,000 to €900,000, depending on complexity and vendor approach. But procurement teams consistently underestimate the scope of expenses. Budget constraints and cost overruns often pose a challenge, as organizations may face unexpected costs during the implementation process, such as additional hardware requirements or customization needs.

The seven cost categories that catch European shippers off-guard include implementation services, carrier connectivity, system customization, training and change management, ongoing support, regulatory compliance, and hidden licensing fees. Consider these TCO components: base licensing (20-30% of total), implementation services (25-40%), carrier integration (15-25%), customization and training (10-20%), and ongoing support (15-20%).

Carrier integration presents particular challenges. Ask specific questions about carrier onboarding: Who pays integration costs? How long do new carrier connections take? What happens when carriers change their API requirements? Modern European providers like Cargoson build true API/EDI connections versus basic account setup.

European-Specific Cost Multipliers That Basic Comparisons Miss

European shippers face unique challenges. Your 12-country carrier networks, multi-modal requirements, and regulatory compliance demands create cost pressures that basic TMS comparisons miss. The European TMS market reached €1.4 billion in 2024 and is growing at 12.2% annually, driven by companies grappling with these complexities.

The complexity multiplies across borders. The complexity multiplies with advanced requirements. Advanced TMS solutions handle different scenarios (transport modes, freight types, regional differences) which require configuration. Compare this to basic solutions that only allow one process flow with minimum deviations - if your workflow isn't supported, you may struggle to achieve promised results.

Many shippers choose sleek, inexpensive solutions only to discover misalignment with their workflow, leading to manual workarounds and contract termination. Vendors like MercuryGate, Descartes, and Cargoson offer different approaches to implementation complexity. Many shippers choose sleek, inexpensive solutions only to discover misalignment with their workflow, leading to manual workarounds and contract termination.

The TCO Reality: Beyond License Fees to True 10-Year Costs

Effective TMS budgeting requires six key metrics: carrier connectivity coverage, implementation timeline, automation percentage, visibility latency, customization flexibility, and 5-year TCO modeling. Benchmark targets include 50-70% automation rates for high-volume operations and sub-hour reporting latency for critical shipments.

Traditional TMS systems cost €100,000+ annually and take months to install, while modern cloud platforms offer faster deployment and transparent pricing. The infrastructure decision significantly impacts your costs. Cloud versus on-premise decisions significantly impact infrastructure costs. Modern cloud-based solutions from providers like nShift, Cargoson, and Transporeon eliminate hardware investments but introduce ongoing operational expenses. On-premise implementations require hardware specifications, OS compatibility considerations, and dedicated IT team support.

But here's what catches European shippers off-guard: recurring costs spread over 10+ years typically link directly to shipment volumes, while one-time implementation expenses hit immediately. This creates cash flow pressures that your initial budget analysis likely missed.

Procurement Due Diligence: Red Flag Questions That Prevent Budget Disasters

Watch for these warning signs during procurement: reluctance to provide detailed cost breakdowns, vague implementation timelines, limited references in your industry vertical, and unclear change request processes. Pricing transparency varies significantly between vendors. Some traditional systems require €100,000+ annual commitments, while others offer usage-based models. Demand clear documentation of all potential charges including setup fees, integration costs, and ongoing support.

Training costs deserve special attention. Training costs depend on user adoption complexity and system interface design. The expertise of the implementation team is critical - inadequate training leads to ongoing support tickets, user frustration, and reduced system utilization. This creates a vicious cycle where poor initial training generates ongoing support costs.

Implementation team quality varies dramatically. Some ERP vendors delegate TMS implementation to external partners, potentially resulting in suboptimal configurations and extended timelines, while experienced teams bring best practices ensuring efficient setup. Cargoson and other modern European TMS providers often include implementation support in their pricing models, contrasting with traditional enterprise vendors who separate these services. The difference impacts your total support costs over the system's lifecycle.

Budget Protection Framework: Contract Clauses That Control Costs

Create vendor comparison templates covering these elements: base licensing (per user, per shipment, or hybrid), implementation services (fixed price or time and materials), carrier integration costs (included or per-connection), training and support (included or separate), and customization charges (configuration versus coding).

Focus on change order controls. These unforeseen expenses can lead to budget overruns and put strain on financial resources. To overcome this challenge, careful cost analysis, realistic budgeting, and thorough vendor evaluation are key. By conducting a detailed cost analysis and considering all potential expenses, organizations can create a realistic budget that accounts for unforeseen costs.

Contract structure matters more than you think. Fixed-price implementations protect against scope creep but may limit flexibility. Time-and-materials arrangements offer adaptability but require tight project management. Negotiating favorable payment terms and exploring cloud-based TMS solutions can also help mitigate financial hurdles.

ROI Reality Check: Setting Conservative Expectations

By deploying a TMS, statistics show that most companies see ROI within 6–18 months, depending on the scale of the implementation and initial investment. But here's what makes 2025 different from previous years: management expects proof upfront, not promises of future measurement. The companies failing with their business cases make three recurring mistakes: Calculating ROI based on maximum theoretical savings instead of realistic benchmarks · Ignoring implementation costs beyond software licensing · Underestimating the time required for user adoption and process changes

Successful implementations from Transporeon, Oracle TM, and Alpega share common traits: conservative ROI projections, comprehensive cost accounting, and realistic timelines. The difference lies in treating the TMS as a business investment, not a technology purchase.

A European retail chain I worked with achieved 8% total cost savings while improving service quality scores. This represents realistic expectations rather than the dramatic transformation promises vendors often make.

Your implementation success depends on accepting the €200K hidden cost reality upfront. Your TMS procurement success depends on understanding these hidden costs upfront. European shippers who invest time in comprehensive TCO analysis avoid the budget disasters that plague hasty implementations. The framework above gives you the tools to build accurate budgets and hold vendors accountable for transparent pricing.

Start by downloading the comprehensive TMS cost framework and adapt it for your specific requirements. When evaluating vendors, include Cargoson alongside traditional providers to ensure you're comparing both established and modern European approaches to implementation complexity and pricing transparency.